Net Worth as Your Financial Compass

A framework for balancing housing, cars, and investments in an era of high rates and record prices.

People often look at their income to help them determine their lifestyle. This sounds like “I make X so I can afford Y”. This can work for small purchases because you can budget and save for them, but this doesn’t help much for larger purchases like a house or a car, purchases that change the composition of your net worth. I’ve been thinking about this more lately, especially in the context of the rent-versus-buy debate. This is an especially complex time to consider purchasing a home because of the historic turnaround in interest rates1 in conjunction with record home price to income ratios2 which is making home ownership a much bigger purchase than it used to be.

The goal is to avoid becoming house poor, stretching for the biggest home you can afford and then struggling to furnish it, handle maintenance, or save. Because a home is often the largest purchase of your life, mistakes here carry far more weight than everyday financial slip-ups.

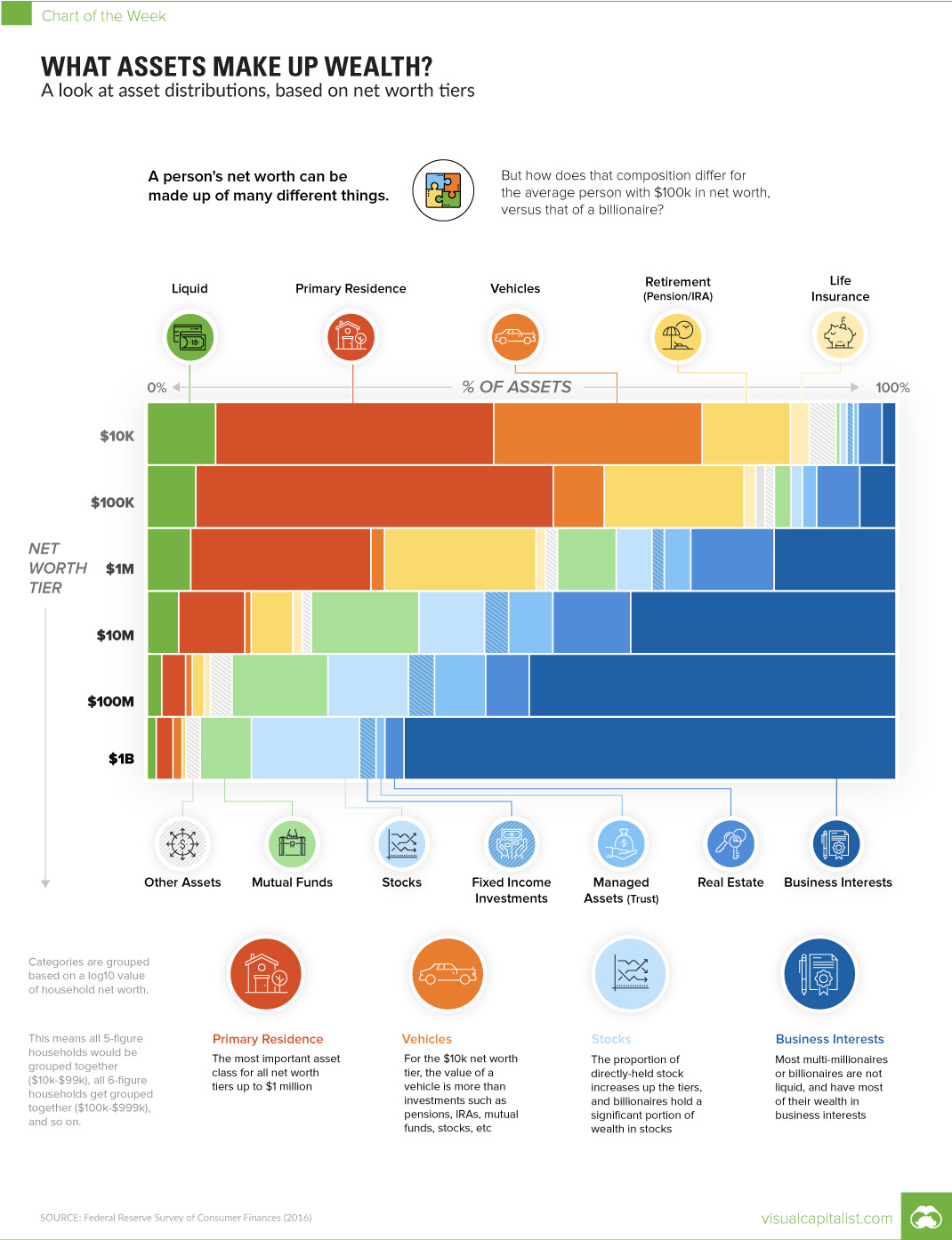

Okay, so let’s start with some baseline net worth percentages by wealth tier to understand where rich people have most of their money.

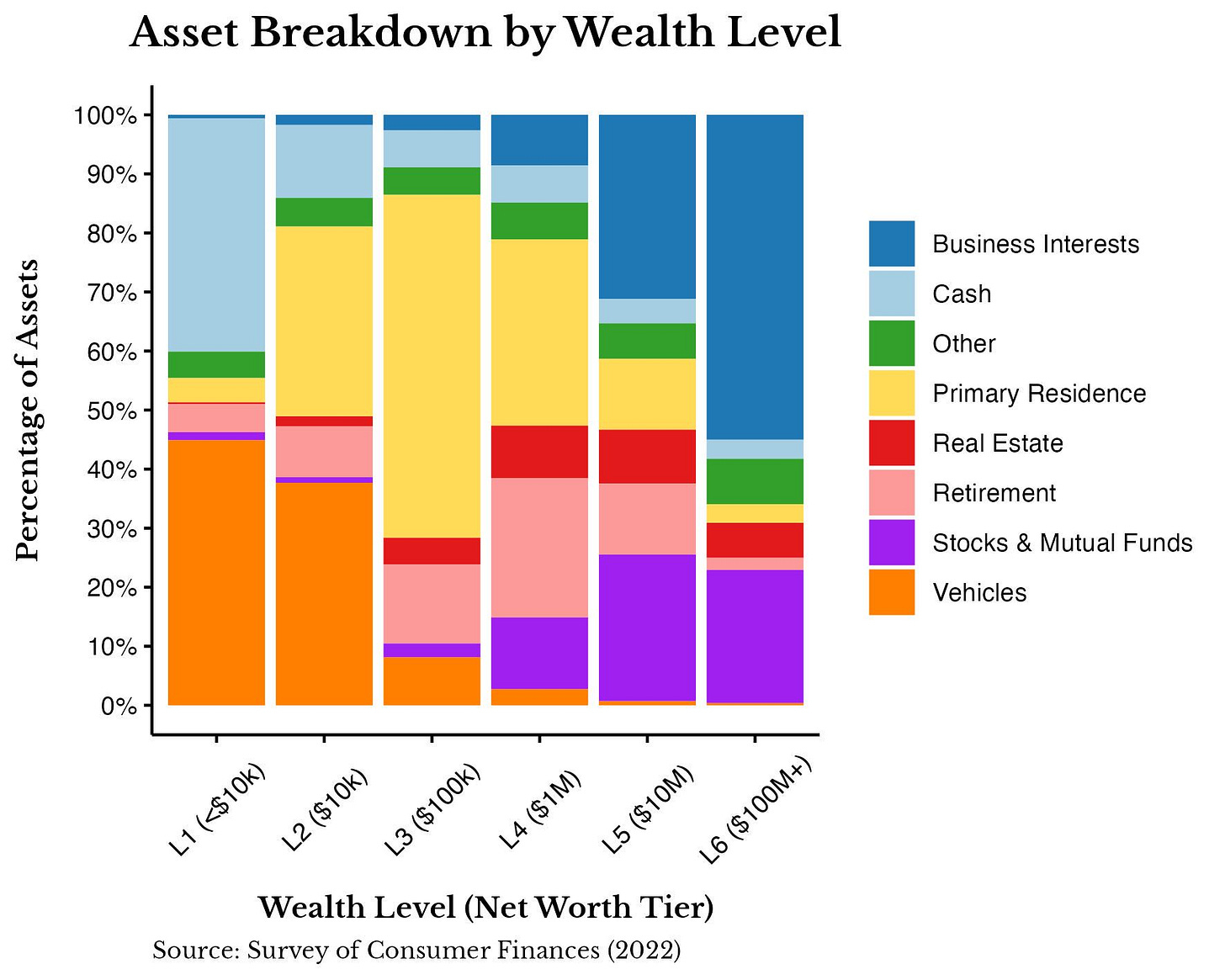

Here’s another chart showing more up to date information from the same survey, but with fewer details on the categories.

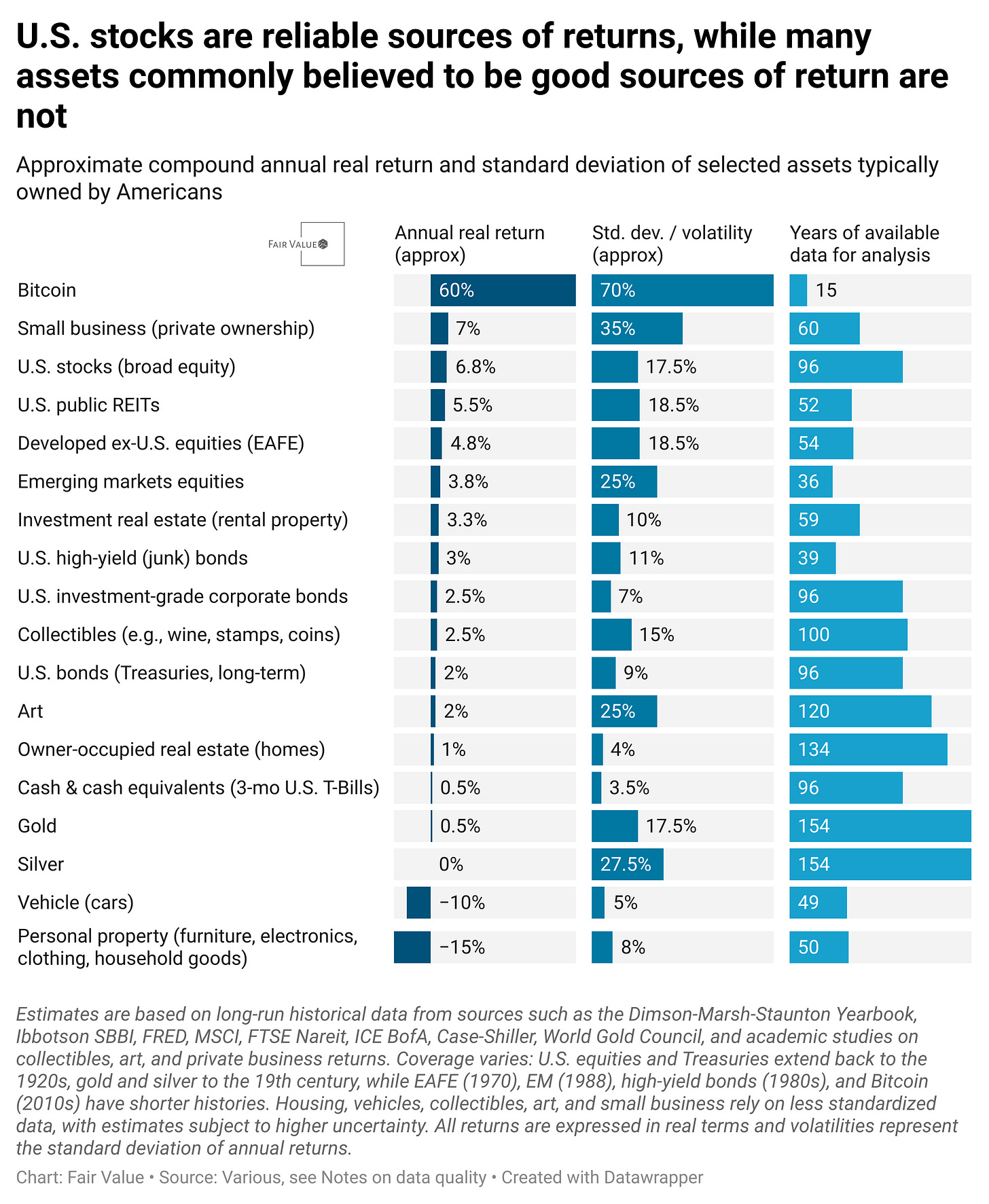

The key takeaway from these charts is that wealth breakdowns vary by the amount of wealth, and that’s normal. Your allocations should evolve over time, but the chart offers a sense of traditional benchmarks. The first important observation is that life changing wealth almost exclusively comes from ownership in a small business. If that is something you’re after, a small business seems to be the path to get there. Stocks tend to make up a smaller portion of net worth across wealth tiers, which is odd considering just how great they are at building net worth. To prove this point, here’s a ranked list of assets by appreciation, depreciation, and volatility:

At first glance, Bitcoin looks like a clear winner for asset appreciation. But with only about 15 years of reliable data, we don’t yet have enough history to judge its long-term returns. Its volatility is extremely high, making it a bad place to commit a large share of net worth until it’s tested across more market cycles. My rule of thumb here is that 30 years of data is needed to evaluate how an asset performs under different economic conditions.

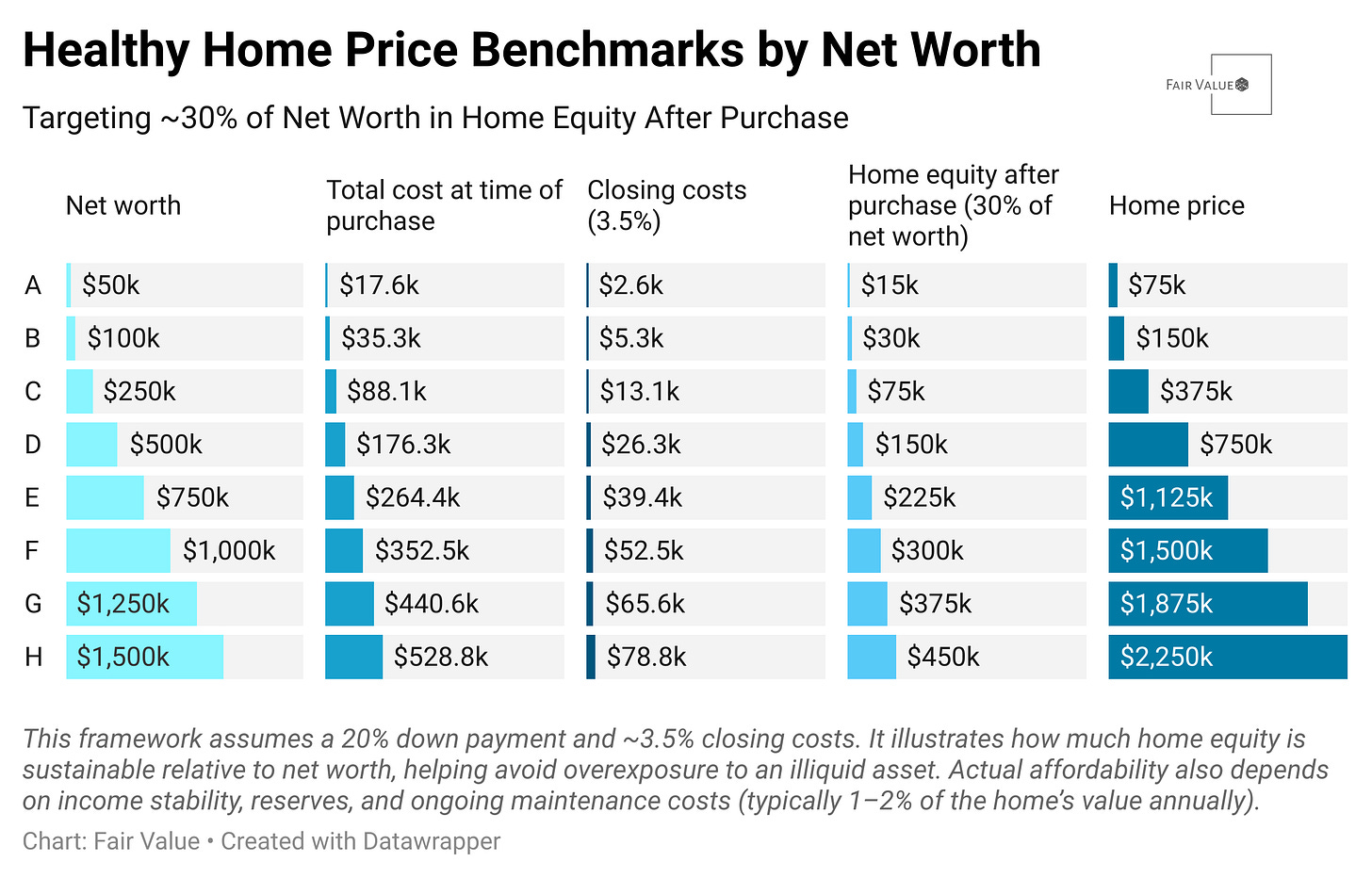

So bringing this back to large purchases, the real goal isn’t just figuring out what monthly mortgage you can afford, it’s deciding how much of your net worth you want locked into a house versus left working in higher-return assets. A simple rule of thumb is to cap housing at around 30% of your net worth. So, if you have $1M, that means about $300K could be in home equity. With closing costs factored in, that $300K roughly covers a 20% down payment, which points you toward homes worth about $1.5M. The exact percentages depend on your financial goals, but the principle is the same: set your target allocation first, then let the math tell you the price range you should be shopping in. Think of the numbers not as rules, but as guardrails that keep you from overextending.

Remember, you also need to consider your income and what mortgage plus expenses you can sustain, but the same net worth principle applies to cars: if your net worth is $250K and you cap depreciating assets at 10%, your vehicles shouldn’t exceed $25K in value. Some advisors, especially in the FIRE movement, recommend keeping it closer to 5%. If you aren’t sure what the value of your cars are, I use Kelly Blue Book and Edmunds to figure it out every couple of months. Also, it’s important to note that these net worth targets may be unrealistic early on, but they’re useful goals to work toward.

So what’s a healthy way to allocate your net worth? It depends on your goals, but setting clear percentages early gives you a framework for these big purchase decisions. It helps you see the trade-offs, know what you can truly afford, and avoid overextending yourself. While advisors differ on specifics, a practical rule of thumb is to keep no more than 5-10% of your net worth in cars and no more than 25-30% in home equity. These guardrails keep your balance sheet flexible and your focus where it belongs, on building long-term wealth.

Board of Governors of the Federal Reserve System (US). (2025). Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10). Retrieved September 18, 2025, from https://fred.stlouisfed.org/series/DGS10

Hermann, A., & Whitney, P. (2024, January 22). Home price-to-income ratio reaches record high. Joint Center for Housing Studies of Harvard University. Figure 2: Home Price-to-Income Ratios Continued to Rise Nationally and in Many Large Metros in 2022. Retrieved from https://www.jchs.harvard.edu/blog/home-price-income-ratio-reaches-record-high-0