14 - How do you compare investments?

We lay the groundwork for all of the things you need to know about to compare investments.

Today I’m going to touch on some fundamentals that we’ll use in a small series on comparing investments. This will culminate in an article on why some people naturally save less vs saving more. This series will help you understand how to invest and will give you the tools to compare investments.

Key points:

Money in the future is less valuable than money today. This means that expected future money should be discounted.

We can compare investment options by considering the rate of return between them.

Risk and reward need to be considered in tandem to effectively consider an investment.

To request a topic anonymously, fill out this form. To reach me with questions, please email alexwarfel@gmail.com. You can also reply to this email directly.

One of the greatest questions in finance is what is this stock worth?

Before we figure out the answer, we need to lay some groundwork by discussing discounting. Discounting is exactly what it sounds like, it’s applying a discount to something. If I gave you $100 today, that would be worth $100. But what if I was going to give you $100 in a month? That would have to be worth less than $100 because it’s not as good as $100 today. In finance, we discount cash flows in the future and we do this because we would rather have something today than tomorrow. This is commonly referred to as the “bird in the hand” theory.

Let’s imagine I was going to offer you $100 in a year for some money today. This is a loan, and we need to figure out how much you’d be willing to give me. Let’s also say that there are four other people that are willing to loan me some amount of money. Some say they’d pay me $80 for me to pay them $100 in a year. Others offer me $85. Everyone is considering two things when they offer $80 or $85:

How much money could they make elsewhere by investing their money? Is it worth it to pledge $85 or $80 for $15 or $20 of reward in a year?

How likely is it that I will actually pay them the $100? Sure we have a contract, but I could die or skip town.

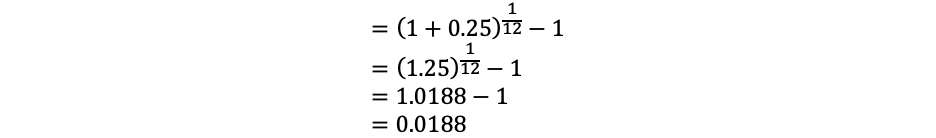

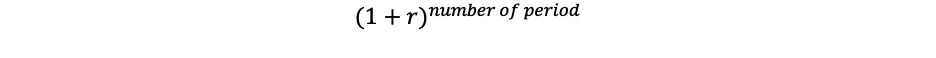

The first point concerns reward, the second risk, often considered in tandem and discussed as the risk-reward tradeoff in finance. Consider two investment opportunities: one costing $400 with a $500 return in a year, and another returning $250 in six months. To compare these two options, we use the rate of return. For the $400 investment, the annual return is 25%1. To find the monthly rate, simply cutting 25% in half won't work due to compounding. Compounding is the process by which you earn interest on your initial investment as well as on the interest that's already accumulated. To transition from an annual to a monthly rate, we use the following formula:

If there is one essential formula to burn into your brain when it comes to investing, the above is it. The addition and subtraction of 1s is essential since 1 serves as a baseline when doing rate math, acting as a pivot between positive and negative values. Consider 0.98. This is the same -2%, while 1.02 is +2%. For instance, when we say an investment grows by 25%, we mean it's now 125% of its initial value. So, to calculate a 25% gain on $400, simply multiply $400 by 1.25.

Using the following math:

we find the monthly rate to be ~1.88%. This implies that starting with $400 and growing it by 1.88% monthly will yield about $500 in a year. To compare with the $250 payout in six months, we can move some terms around in the above equation and come to:

This value is known as the discount factor. Once we have the discount factor, all we need to do is divide $250 by this discount factor. After doing this math, we find the equivalent present value to be $223.61. This means we would be willing to pay $223.61 for $250 in the future. This method, akin to how bonds are priced, helps investors evaluate offers consistently, comparing annualized yields to decide where to invest. This also introduces a discussion on risk, which impacts the rate investors are willing to offer.

Risk is the idea that our future plans will be different than we expect. Since we know that we can’t predict the future, we know there is at least some risk. But how much? This is where most of the magic happens. Lets consider the offer for $500 in a year. Lets say the offer is made by a well known company that has missed some payments in the past. Lets also say that we have never missed a payment once. This means we’re more creditworthy than the $500, so investors shouldn’t get as much reward for risking their money with us. This means some investors are willing to lock up $85 instead of $80 with us because they trust us. This means the yield is lower for our offer because we are more creditworthy. Yield and risk are deeply tied together, because investors demand more reward for taking on greater risk, but many don’t agree on how risky something is, which is how price differences occur in the market.

Risk is commonly calculated using standard deviation of the price movements over some period. One problem with this is that some investors hold the investment until it matures, meaning that the price movements that occur while they own the investment doesn’t actually matter. Furthermore, standard deviation is best used on data that is normally distributed, and investment returns are not normally distributed.

In the next article we will talk about how to apply these concepts to actually determine the value of a stock.

Support

If you’ve enjoyed this article and you’d like to support me, please consider checking out some of the spreadsheets that I’ve built to make your financial planning easy. Thank you!

=(500/400)-1