11 - Time diversification

Does staying in the market longer reduce risk?

Hi everyone, a little bit of housekeeping first. I will not be writing these as consistently going forward. I want to take the time that each of these topics deserves to deeply understand them and present them in as helpful of a way as possible, and that takes time. If it’s not worth doing right, it’s not worth doing. Thank you for subscribing and I hope you find these topics as interesting as I do! As a reminder, this article is for informational purposes only, this is not legal, tax, investment, financial, or other advice.

To request a topic anonymously, fill out this form. To reach me with questions, please email alexwarfel@gmail.com.

Key points:

Historical returns data seems to suggest that investors can reduce the riskiness of their portfolios by just holding onto them for a longer period of time.

Mathematically, investors should be indifferent between risky and safe assets regardless of their investment horizon. This means there is a case to be made for holding treasury bills as a retirement portfolio, albeit an incomplete one.

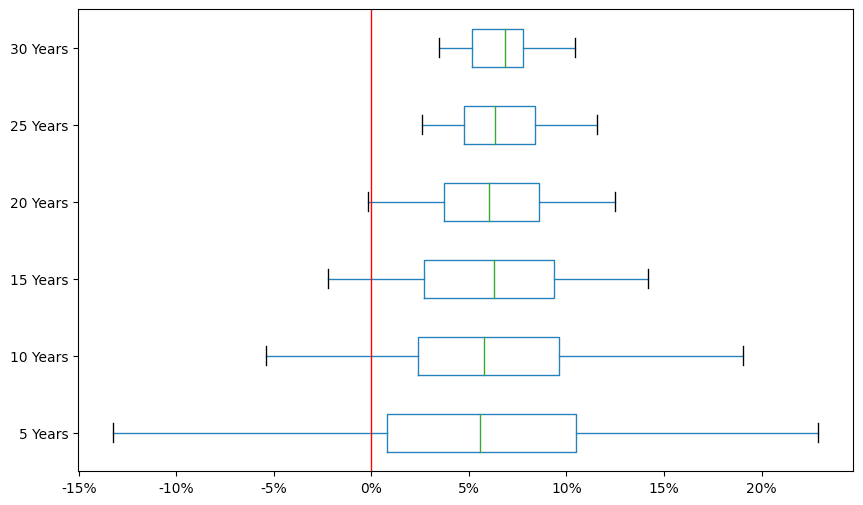

You likely know by now that time in the market is better than trying to time the market, but does staying in the market longer reduce risk? Here is a box and whisker plot for the annualized real returns for the S&P 500 since 1900.

S&P 500 annualized returns by investment horizon

An investment horizon is how long you keep your investments. Generally, the longer this period, the less your returns seem to vary, a notion called time diversification. According to US data, holding equities longer seems to reduce risk. Specifically, in the US, it seems holding investments for at least 25 years can prevent losses.

However, this doesn't apply everywhere. Take Japan for instance, where even after holding investments for multiple 30-year periods, capital loss was still experienced, primarily due to the asset bubble in the '90s.

Nikkei 225 annualized returns by investment horizon

But, interestingly, it does seem to be the case that holding on longer has reduced risk even if some 30 year periods did result in negative returns.

So as an investor, does this mean that if you have the time, you should load up on riskier assets?

Time diversification, where returns seem to stabilize over time, depends on returns being mean reverting, that is, good returns follow bad ones and vice versa. This concept, also called negative serial correlation, is akin to autocorrelation or lagged correlation. As per SLCG Consulting, Paul Samuelson, a Nobel Laureate, demonstrated that if returns don't exhibit this correlation, investment risk doesn't decrease over longer periods. While negative serial correlation is observed in market returns, it doesn't occur to the extent needed to reduce risk.

In fact, assuming these three criteria below are met, investors should be indifferent between a risk free asset like treasury bills and risky assets like stocks:

Your risk aversion is invariant to changes in your wealth.

You believe that risky returns are random.

Your future wealth depends only on investment results.

The second point is disputable and depends on your definition of 'random'. However, research clearly indicates the first point is incorrect. The third point is also false because your future wealth isn't solely dependent on investment results. It's also affected by your career progression, savings, and spending habits.

In summary, according to a CFA literature review, there's no mathematical justification for younger investors to heavily invest in risky assets. To understand the math behind this, refer to the provided link. However, this doesn't consider that young investors can compensate for underperforming investments by working harder to boost their salary, or by cutting spending and investing more. Therefore, investing in riskier assets while young still has a logical basis. This all being said, it’s still wise for younger investors to increase the risk in their portfolios and reduce that risk over time with asset allocation.

Support

If you’ve enjoyed this article and you’d like to support me, please consider purchasing some of my spreadsheets that I’ve built to help out your financial planning. Thank you!