Thoughts on DIY financial planning

Develop a custom system for yourself and recognize you can't plan for everything

Housekeeping: There will not pro article today. Just some thoughts on DIY financial planning.

Key points:

Instead of relying on turnkey solutions like spreadsheets and apps, developing your own system to manage your finances is worth the time. Customize to your heart’s content and improve this plan over time.

Do not guilt yourself into planning for every conceivable future scenario. Attempt to cover the basics and consider new risks as they emerge over time.

To get in touch, request a topic, or ask a question, email alexwarfel@gmail.com. You can also reply to this email directly.

Develop your own system

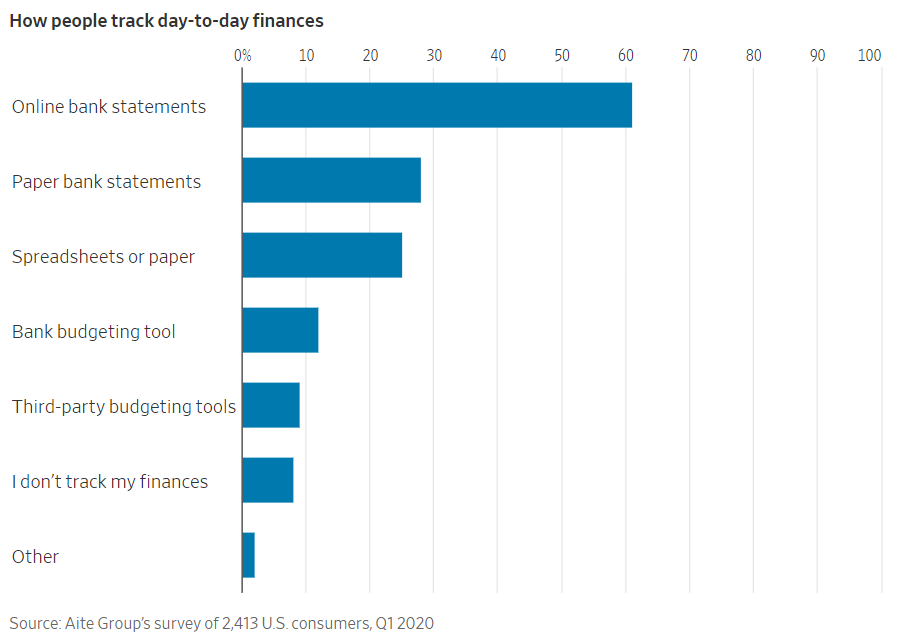

One size fits all solutions do not work when it comes to financial planning, so mold what you see online to work for you or start from scratch. In a recent article by WSJ, Imani Moise notes that most people prefer to use their own spreadsheet over apps in order to track their finances.

This should encourage you to sit down with a spreadsheet and come up with a plan that works for you. A few interesting points from the article:

The first thing Kenneth Coombs, a financial adviser in London, Ontario, does when working with new clients is make them plug all their daily expenses into a spreadsheet. The pain of typing all the data replaces the pain of handing over cash, he said. Taking more time to consider each transaction can counteract frictionless payments with the wave of a card or smartphone that make it easier to spend mindlessly.

Remember that one of the biggest hurdles in managing your spending is confronting the psychology of money. Frictions are the small obstacles or challenges that slow down the spending of money. Companies work hard to reduce these frictions because it leads to more spending from consumers. This is often presented to you and I as an enhancement to the shopping experience. Popular examples include Apple issueing a credit card that lets you easily pay for your iPhone with payments. If you’re trying to save by spending less, try to incorporate frictions into your spending. This could take the form of leaving credit cards at home, or only using cash to purchase things. Using cash means you have to experience the pain of parting with your money, and you also need to go to an ATM to refill your wallet, which can be annoying.

Another interesting point that should bias people towards using spreadsheets is just how poor the adoption of financial planning apps are.

Those who try the apps tend not to stick with them, according to a 2020 survey by research group Aite-Novarica. Though 90% of people between the ages of 24 and 54 said they have linked an account to one of these tools, 20% reported using them within the last three months, the survey found. More people say they regularly use spreadsheets than these budgeting services from banks or third-party apps.

Don’t fool yourself, putting time and effort into a custom budget is well worth it.

Identify risks that you face, and accept that you will not be able to plan for every contingency

One thing a financial advisor can help out with is identify goals and risks and how to plan for them. If you want to do this yourself though, it isn’t too difficult. The steps are generally as follows: Note, I use goal and risk interchangably!

Create a list with four columns. The first column is the name of the goal, the second is the estimated cost associated with it in today’s dollars, and the third column is the date when you will want to achieve this goal or mitigate this risk. Identify anything that could be a goal that you will face sometime in the future. The idea is to make as big a list as possible. This will include things like retirement, car purchases, etc. Consider that you’ll likely buy a few cars in your lifetime, so make a separate goal for each car, and space them out over when you think you’ll purchase a new one.

The fourth column identifies which account you will use to meet the goal. Check the third column, and if the time to that goal is less than five years, write “savings”. Otherwise, write “investments”. For the goals that you don’t know the date or amount, attempt a guess. For retirement, this could be 65 years old, or another age if you’re targeting something different.

Next, determine how much to set aside for these goals. For the ones with a specific dollar amount, use the PMT formula in Excel or Google Sheets. It’s worth the time to get very comfortable with this formula. The rate of return for anything in an “investment account” should be about 4-6% per year. This number is lower than the standard 8% market return that is often quoted because we need to subtract inflation. The rate for anything in “savings” is probably closer to 1-2%. Work with a financial advisor on these numbers, and also bias those rates lower to be more conservative (i.e. more likely to reach your goals by trading off more money committed to those goals ahead of time). If you don’t know the amounts for the goals, do some research to understand what those goals typically cost today.

Reassess these goals each year in a ritual. Most will do this in December and align their first paychecks to this plan in January. Recognize your financial plan will grow and evolve to fit your needs.

The last piece of advice here is that you can’t plan for everything. Recognize that events in life will come out of nowehere, and use your emergency savings as a buffer for them. It’s impossible to plan for everything, so just do your best and work on improving every year.

Support

If you’ve enjoyed this article and you’d like to support me, please consider checking out some of the spreadsheets that I’ve built to make your financial planning easy. Thank you!