The Illusion of Control: Why Predictions Fail and How to Thrive in Uncertain Markets

Decoding the randomness of markets, the power shifts in industries, and the demographic trends reshaping our future.

Here is a roundup of some of the most interesting things I came across this week. This is an 14 minute read.

Key Trends:

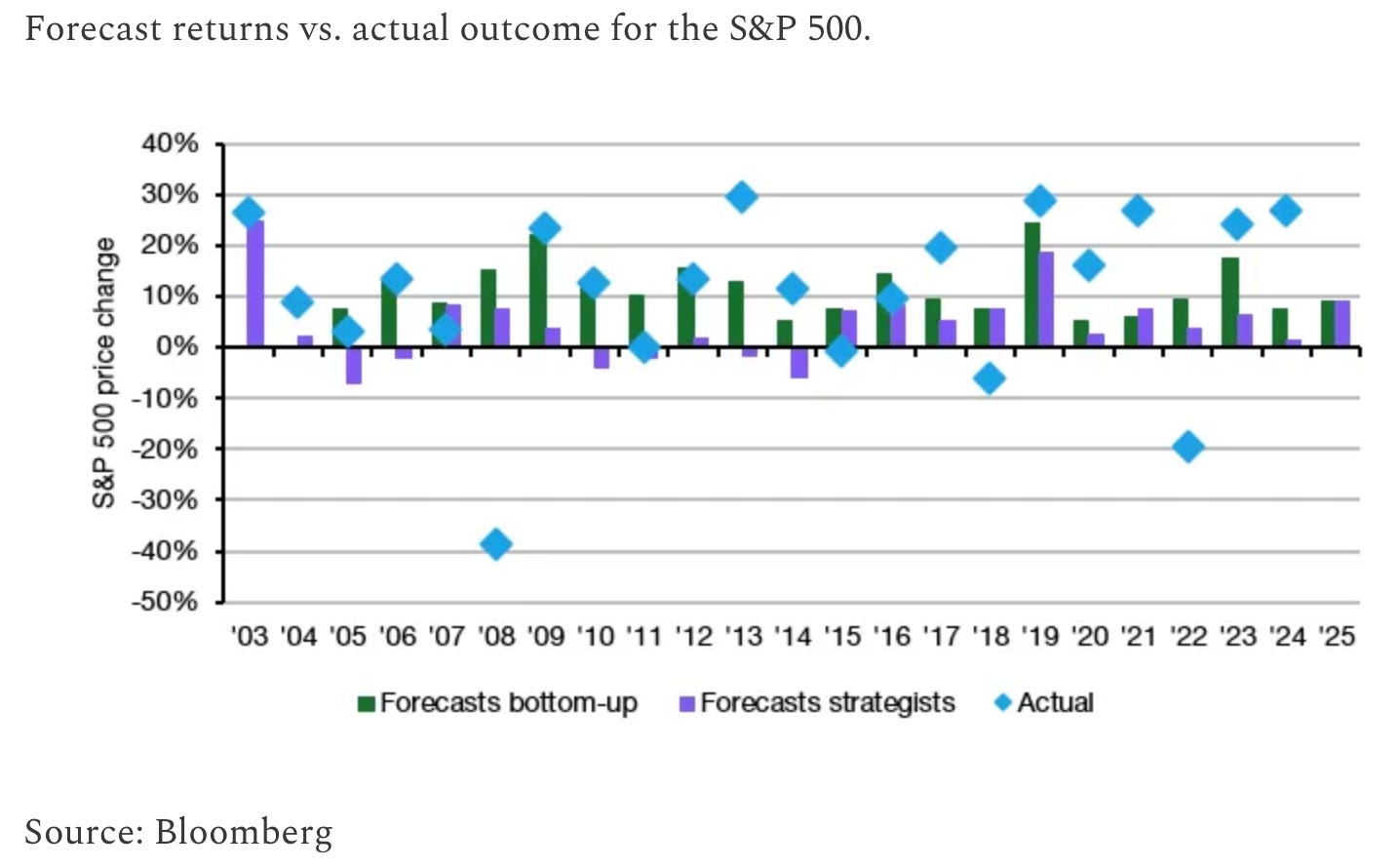

1. Market Forecast Failures: Short-term market predictions rarely align with reality. Research like Eugene Fama’s Efficient Market Hypothesis shows stock prices follow a “random walk,” making predictions unreliable. Over-reliance on forecasts leads to faulty investment decisions—focus on fundamentals like future cash flows instead.

2. EV Leasing Boom Fueled by Subsidies: Leasing now accounts for 45% of EV transactions, thanks to a $7,500 federal tax credit. While leases lower upfront costs, they reflect strained consumer finances and raise questions about whether subsidies distort markets and true environmental impacts.

3. Employers Take Back Power: Remote work is fading as employers enforce office returns, with JPMorgan and Dell mandating five-day weeks. Cooling demand for white-collar jobs and AI-driven role displacement leave employees with less leverage, signaling a shift in workplace norms.

4. Demographics Threaten Growth: U.S. deaths are projected to outpace births by 2033, while China’s population declined for the third year. Falling birthrates and restricted immigration risk shrinking labor forces, slowing innovation, and straining social programs.

5. Corporate Earnings Shine Amid Risks: Q4 2024 earnings crushed expectations, with 79% of S&P 500 companies beating EPS estimates. Banks like JPMorgan posted surging profits, but rising consumer debt and elevated P/E ratios hint at potential vulnerabilities if rates rise again.

Predictions captivate us. They make headlines and spark conversation. Yet the reality often plays out differently, proving those forecasts wrong. This isn’t surprising. For decades, the correlation between many one-year market forecasts and actual returns has been minimal or even zero as highlighted by research in this piece. Forecasters lay out theories and models, but those are powerful mainly as marketing. They draw attention and make professionals appear deeply informed. The trouble is, real-world markets don’t often follow neat scripts, especially given the randomness of asset prices and the unknowns in how global forces evolve.

Understanding this unpredictability helps anchor us in the deeper fundamentals. At the core, any asset’s worth hinges on future cash flows, discounted back to their current value. Figuring out both the real potential of those future returns and the discount rate is where the magic lies. Meanwhile, as the same article explains, these year-ahead guesses can become “toxic” anchors for investors’ minds, setting up faulty expectations.

This idea of market unpredictability isn’t new. The concept of randomness in asset prices was famously popularized in Eugene Fama’s groundbreaking 1965 paper, The Behavior of Stock-Market Prices (Fama, 1965). Fama demonstrated that stock prices move in a “random walk,” meaning their changes are independent of past movements and primarily driven by new, unpredictable information. This randomness makes short-term predictions unreliable because markets quickly absorb available information. Fama’s Efficient Market Hypothesis (EMH) argues that no amount of historical analysis can consistently predict future prices, as the market price already reflects all publicly available data. His research remains a cornerstone of financial theory, challenging the belief that active stock picking can outperform passive strategies.

Despite the evidence, predictions persist because they appeal to our need for control and understanding. Behavioral economists like Daniel Kahneman and Amos Tversky have shown how cognitive biases, such as anchoring, make people prone to latch onto initial figures—even if those numbers are baseless. For example, when forecasters publish target returns or price levels, investors unconsciously adjust their expectations toward those figures, whether they’re realistic or not (Kahneman & Tversky, 1974). This psychological tendency often leads to misaligned investment decisions, with people basing strategies on predictions rather than sound fundamentals. Recognizing the limits of forecasting and focusing on long-term principles can help investors avoid costly mistakes and emotional traps. By staying grounded in the unpredictability of markets, investors are better equipped to handle the uncertainties of asset pricing.

Leasing in the EV Market: A Costly Fad or Logical Move?

Vehicles might feel more tangible than stock predictions, but the forces behind their pricing can be just as murky. We’ve seen a sudden surge in EV leasing. Toyota’s bZ4X, which starts at around $37,000, ends up in a lease for almost everyone, per this report. In the third quarter of 2024, 45% of EV transactions were leases, up sharply from 24% for the auto industry overall. That surge is fueled by a $7,500 federal tax break that applies more easily to leased electric cars than to purchased ones.

Car companies love it, because it lowers the monthly payment that consumers see on the sticker. But you can debate whether this broad adoption of leases signals genuine excitement about EVs or a desperate push to squeeze out monthly payments consumers can afford. The standard view is that leasing is the most expensive way to own a car over time. It might hint that people’s finances are strained, pushing them to chase smaller monthly obligations. Meanwhile, it also draws on government funds: Automakers’ financing arms collect that $7,500 credit on a lease that might not even require North American battery sourcing. This is a costly taxpayer outlay for EVs that may not be as green as intended if you factor in battery mining and electricity generation from coal.

Some of this feels like a distortion of the market: The bigger the subsidies, the more behavior can become artificially shaped by them. Are used gas-powered cars actually more eco-friendly when you count the full supply chain? The answers are complicated and often debated. But at the very least, short-term leasing, backed by taxpayer money, doesn’t strike everyone as the ideal fix for environmental challenges.

Employers Regain Control in the Labor Market

While electric-vehicle leasing highlights ways consumer demand is propped up, changes in the labor market show how power can quickly swing back to employers. After years of employee leverage, many bosses now push for a stricter in-office routine. Companies like JPMorgan Chase and Dell have mandated more days at the office, often five days for some workers, according to these findings. Some corporate leaders argue productivity suffers when employees are fully remote. Others see remote or hybrid work as a perk that simply isn’t as necessary if job openings shrink and talent becomes more replaceable.

In the meantime, employees who prize flexibility feel the strain. The pushback has been huge for white-collar professionals who believed a hybrid approach to work was here to stay. A key detail is the overall labor market: White-collar roles are experiencing weakening demand, while industries like healthcare and public services drive half the recent job gains. That’s cold comfort for knowledge workers who think new advanced AI tools might replace them and their office duties. As a result, we’re likely to see companies requiring more days on site—maybe pushing that to five days for the vast majority of white-collar workers by 2026. If that is indeed the trend, it underscores how employer leverage has rebounded.

Could the Fed Raise Rates in 2025?

Higher interest rates in the past year have already hit markets, but most people assumed the Federal Reserve was done tightening for a while. Yet some watchers say the Fed might turn around and increase rates this year if the economy stays hot or inflation recurs. It sounds jarring, given that we just watched a strong cycle of rate cuts in 2024. Still, historically, the Fed usually signals big changes well in advance. It’s rare for them to flip from cuts to hikes so quickly. Investors are on edge because if the Fed reverses course and lifts rates, stocks might take a beating.

That fear shows the Fed’s outsize role in valuations. Because interest rates affect the discount rate for future cash flows, a rate increase can slash what investors think stocks are worth. And it’s easy to see how surprising moves from the Fed can wipe out bullish sentiment in an instant. While some experts argue the Fed might stay on hold, the possibility of a short-term hike underscores how “futile” predictions can be. Even the best macro calls can be undone by an unexpected turn in inflation or policy.

Meanwhile, official measures of inflation remain mixed. The consumer price index recently came in at 2.9% year over year, but more volatile components such as gas jumped 4.4% monthly, according to this analysis. That leaves the Federal Reserve still in a wait-and-see mode on whether it should keep cutting, stay steady, or tighten. Some call this a “Goldilocks economy”: not too hot to cause runaway inflation, but not so cool that unemployment skyrockets. Yet the unpredictability of global events, from new tariffs to geopolitical tensions, always lingers in the background.

JPMorgan and Goldman Profits Jump: A Clue About the Economy

The big banks are also sending signals about how resilient corporate America is right now. JPMorgan Chase posted a 50% surge in quarterly profit, hitting $14 billion. Goldman Sachs more than doubled its profit to $4.11 billion, as noted in these results. Demand for investment banking, trading, and loans rebounded after a choppy period. The bank’s CFO said the environment is driven by “significant optimism in the C-suite.” Interestingly, part of that optimism might come from hopes for a pro-growth administration in Washington. But the consumer side reveals cracks—JPMorgan said net charge-offs rose 9%, mostly from its credit-card business. That suggests regular Americans are leaning more on debt, possibly a sign of stretched finances.

One big picture question: If big corporations have easy access to funding and investor capital, does that keep inflation higher? Possibly. Abundant financing can push up spending and investment, which might send more money chasing the same supply of goods. And the Fed, already grappling with uncertain price pressures, might respond by raising rates again or holding them high for longer.

Harvard MBAs Aren’t a Sure Bet

Signs of a tougher hiring landscape aren’t limited to mid-level positions. Harvard Business School found that 23% of its M.B.A. graduates who were seeking jobs were still unemployed three months after leaving campus, according to this report. Those are Harvard graduates—people who might assume the brand name alone opens doors. This rising share of still-searching grads (up from 10% in 2022) reflects an overhang in white-collar hiring. Tech and consulting giants have pulled back on recruiting, or even deferred job start dates by months, leaving newly minted MBAs in limbo.

That stands in stark contrast to earlier business cycles, where top graduates often had multiple offers. AI also factors in, particularly because many entry-level tasks these professionals performed—like data crunching or writing initial analyses—could be automated by agents. If the hallmark of an M.B.A. is synthesizing data quickly and pitching recommendations, generative AI could become a substitute for junior talent, especially in large organizations trying to cut labor costs.

Population Pressures Looming

Labor markets of tomorrow also hinge on demographic shifts. Recent data show that U.S. births might fall below deaths within the decade, per a Congressional Budget Office forecast. That suggests the American population could shrink without enough immigration to offset it. For context, the CBO had predicted births would outpace deaths eventually, but new data show the shift could happen seven years earlier than initially thought. Lower fertility plus tight immigration policies mean fewer young or new workers entering the labor force. An aging population might keep the cost of labor high, but also strain social programs if fewer people pay into them.

China, meanwhile, faces a similar challenge. Despite a small rise in births for the first time in eight years, China’s population still declined overall last year, according to official statistics. An older population makes it tougher to sustain growth, and it raises big questions about how the global economy will handle two of the world’s largest countries simultaneously aging. For investors, that can affect everything from global demand for consumer goods to government bond yields and currency movements.

Recent research underscores the complex economic consequences of declining populations. A 2022 study by economist Charles I. Jones, published in the American Economic Review, suggests that a shrinking population can lead to reduced innovation and slower economic growth, as fewer individuals are available to generate new ideas and drive technological advancements. Additionally, a 2024 report by McKinsey highlights that many of the world’s wealthiest economies must at least double their productivity growth to sustain historical increases in living standards amid declining birth rates. Countries like the UK, Germany, Japan, and the US need to achieve double the productivity growth rate experienced over the past decade, while France and Italy require a tripling, and Spain needs a fourfold increase by 2050. These findings indicate that without significant increases in productivity, countries facing population decline may experience stagnating or even decreasing living standards. Therefore, while a declining population might alleviate certain environmental pressures, it poses substantial challenges to economic growth and societal well-being, necessitating proactive policy responses to mitigate potential negative impacts.

A Resilient Earnings Season, but Are Expectations Too High?

Despite these long-term demographic headwinds, the S&P 500’s early fourth-quarter 2024 earnings mostly beat estimates. So far, 79% of reporting companies have surpassed analysts’ EPS projections, as shown in the latest data. That puts overall year-over-year earnings growth at around 12.5%. If that stays consistent, it’s the highest in about three years. This outperformance has pushed valuations even higher, though. The forward price-to-earnings multiple on the S&P 500 stands around 21.6, well above its 10-year average of 18.2.

When stocks appear pricey and the Federal Reserve could shift policy, caution is warranted. Over-optimism can backfire if interest rates rise or if those high-growth assumptions falter. Equities might stay strong while corporate reports look good, but a sudden revision of rate expectations—often triggered by inflation, geopolitical events, or unexpected supply shocks—can send valuations downward fast.

Interconnected Risks: From Forecasting to Policy

The mosaic of news underscores a bigger point: short-term forecasts can be fragile. Observers build models on assumed growth or stable policies. But markets can whipsaw due to macro shifts and policy changes nobody saw coming. If auto incentives suddenly shift, EV lease popularity might drop. If the government reduces federal employment, those robust job numbers might plummet. If the Fed decides it needs to tighten again, equity markets might correct. And if birthrates keep sliding, labor markets could see new distortions in the next few decades.

Focus on Adaptability

Uncertainty is an inescapable feature of both investing and career planning, and success often hinges on adaptability rather than reliance on rigid forecasts. Historical evidence, like Eugene Fama’s work on the Efficient Market Hypothesis (Fama, 1965), demonstrates how markets are shaped by random and unpredictable events, making precise predictions unreliable. Investors benefit from maintaining balanced portfolios that combine growth-oriented assets with safer ones to buffer against economic shifts, as highlighted in studies on portfolio diversification (Markowitz, 1952). Similarly, workers must prioritize developing skills that resist automation—such as emotional intelligence, leadership, and creative problem-solving—since research from McKinsey in 2021 suggests that nearly 25% of jobs could be disrupted by AI by 2030. Granted, this is of course, a prediction. Flexibility in both investing and career paths provides resilience in a world where technology, policy, and economic trends evolve rapidly.

Predictive certainty is often an illusion, as demonstrated by Wall Street forecasts, which serve more to generate attention than to provide reliable guidance. The Federal Reserve’s unexpected moves, like rate hikes or cuts, often underscore the limitations of these predictions. Furthermore, the $135 billion in stolen pandemic-era unemployment benefits, detailed in a 2023 federal audit, exemplifies how well-meaning policies can be derailed by unforeseen exploitation. The takeaway is clear: whether in markets or policymaking, overconfidence in any single forecast can be dangerous. Instead, focusing on fundamentals—like assessing the intrinsic value of an asset or strengthening job-relevant skills—offers a more stable foundation. By acknowledging uncertainty and staying adaptable, individuals can better navigate the challenges of an unpredictable world.