Tariffs, Time Horizons & Trust: A 2025 Field Guide for Investors

How a Fed stuck on pause, a split-personality stock market and eroding faith in institutions could hit your mortgage, portfolio and peace of mind, plus the habits and hidden assets that still compound

Tariffs have forced the Fed to sit tight, here’s how the policy freeze could sway your mortgage, portfolio, and next home purchase.

Key Takeaways

In the News - Tariff turbulence is the economy’s stealth headwind: April CPI was a calm +0.2% m/m and 2.3% y/y, but ADP hiring plunged to 62k in April, down from 147k in March, and NFIB optimism slid to 95.8. Trump’s whipsaw levies, 145% on some Chinese goods one day, a 90-day partial truce the next, are denting cap-ex, hiring, and housing before they hit the CPI.

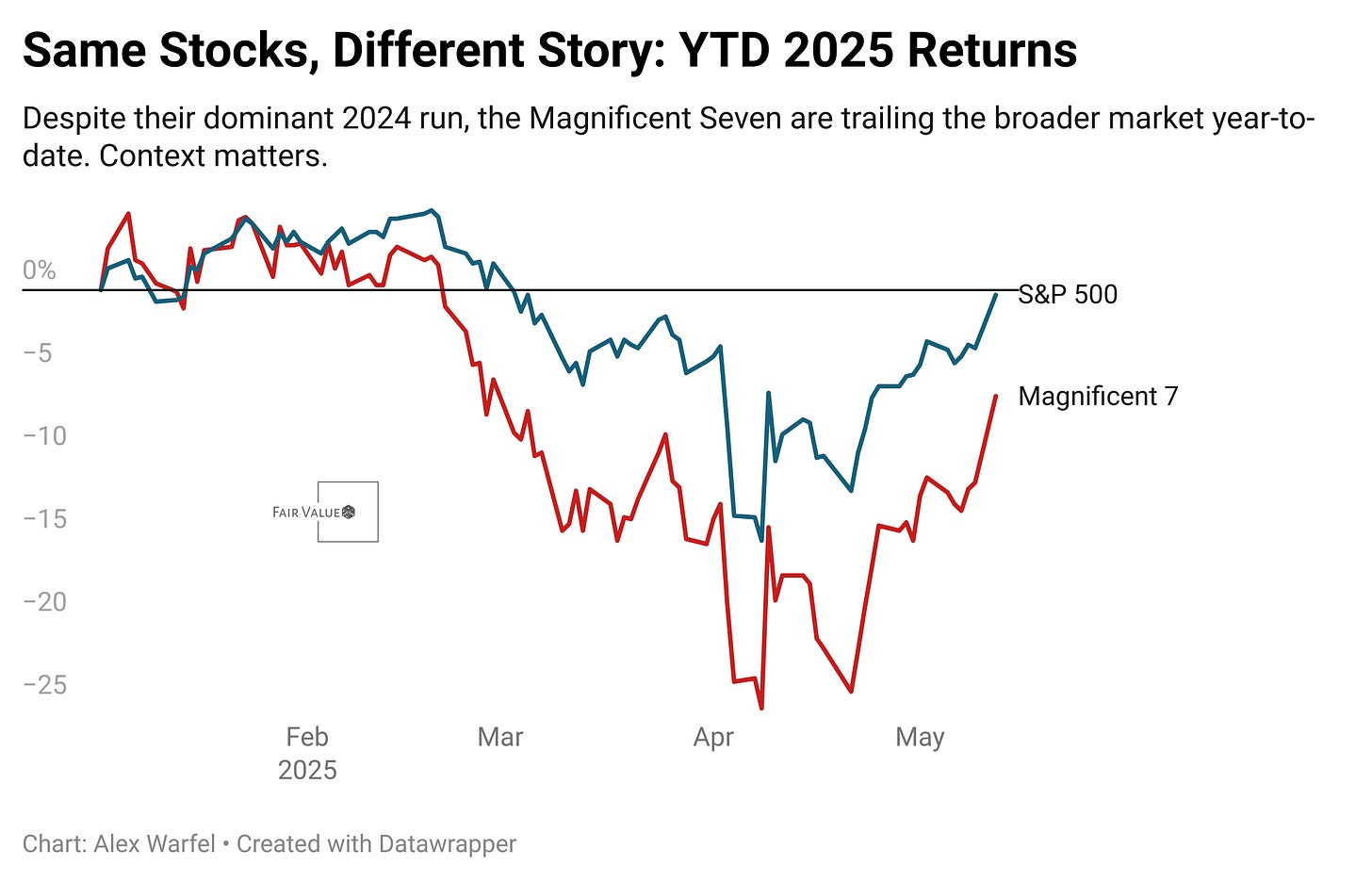

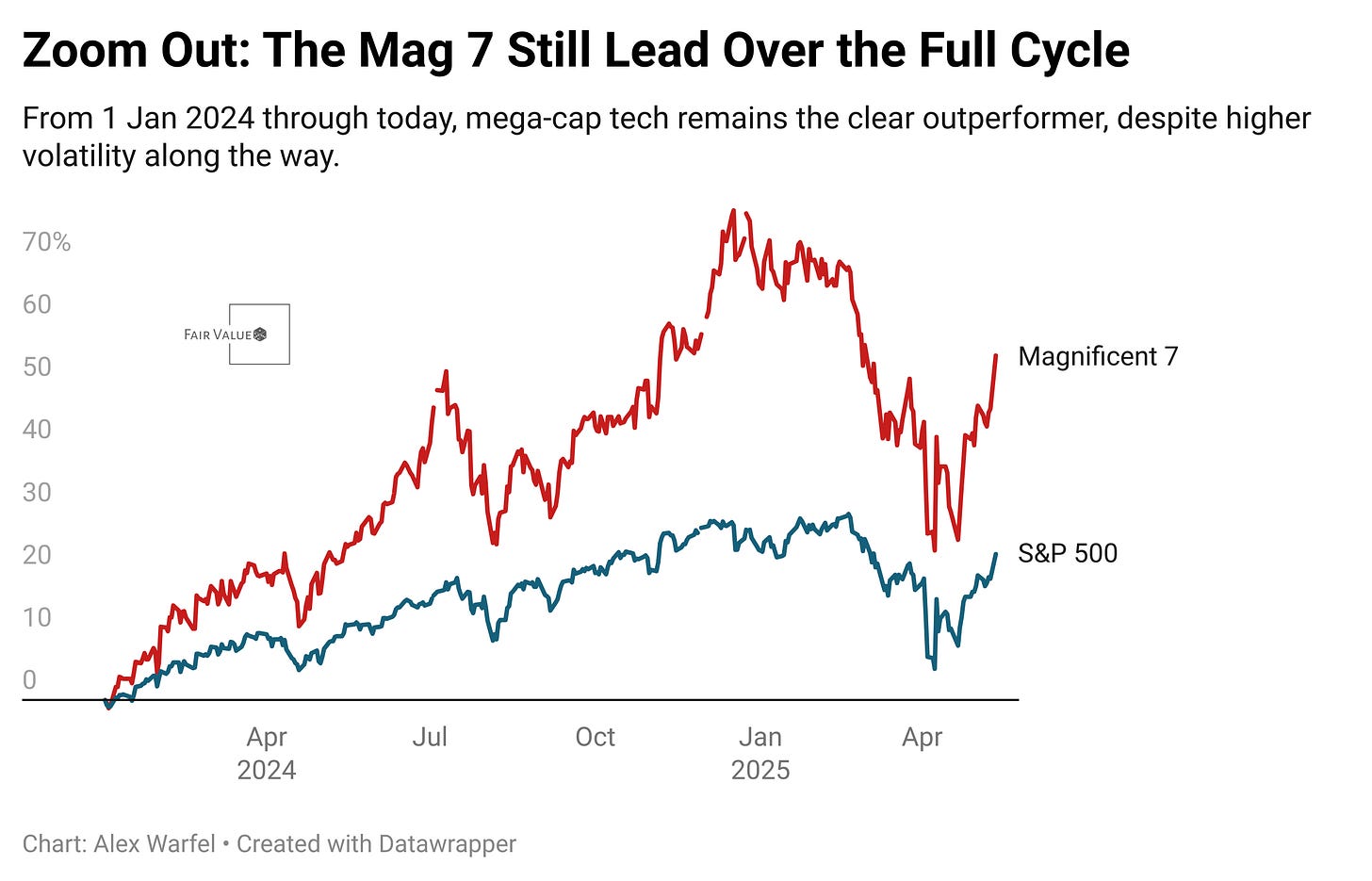

Chart of the Week - Time-frame roulette can flip any narrative: YTD-2025 the Magnificent 7 are -6 percentage points behind the S&P 500, but zoom out to Jan-2024 and they’re +60% vs +25%, a reminder that higher-beta winners retrace hard yet still dominate long runs.

Beyond Bias - Projection bias makes today’s tastes look permanent: Personality research shows more change between ages 20-40 than after 50, yet investors still panic-shift to cash or over-consume on the assumption their current risk tolerance or hobbies won’t evolve. Saving is the hedge against your own shifting future self.

Building Wealth - Your highest-yield assets don’t trade on an exchange: Time, health, autonomy, and relationships explain more life-satisfaction variance than income (Diener & Seligman, 2004); a weekly walk with a friend or a protected “no-meeting Friday” can deliver compounding psychological dividends that crush the ROI of most portfolio tweaks.

Historical Perspective - The 1974 Trust Crisis shows what happens when confidence snaps: Watergate, 11% inflation and the oil embargo sent consumer sentiment to record lows and gold from $65 to $180/oz; today’s rush into crypto and bullion echoes that same flight from institutions, consensus is a fragile asset class.

Literature Review - AI ‘attention signals’ beat ‘action signals’ for durable skill-building: In a 2,484-game chess randomized controlled trial (RCT), action cues lifted accuracy most in the moment, but attention cues delivered 40% of the gain with positive spillovers to later moves and higher perceived agency, designers (and investors) should favor tools that force users to think, not just click “Buy.”

In the news

The data dribbling in this May all point in the same direction: tariff turbulence is rippling from boardrooms to kitchen tables, cooling a recovery that had finally begun to feel durable. The April consumer-price index looked benign at first glance, headline inflation rose just 0.2% on the month and the year-over-year rate slipped to 2.3%, its lowest since early 2021. But economists were quick to note what wasn’t yet inside the report: the full cost of President Trump’s rolling trade war. With 10% “universal” duties announced on April 2, a temporary 145% levy on Chinese goods days later, and then a surprise 90-day tariff truce struck this week, import prices are still working their way through inventories and supply chains. Fed officials, wary of a summer pass-through, are effectively frozen, hoping the sunshine in the latest CPI isn’t just the eye of the storm.

Corporate behavior suggests they share the Fed’s caution. Big employers from JetBlue to T. Rowe Price are now talking about “selective pauses” rather than layoffs, a strategy that keeps payrolls steady but leaves job seekers with fewer openings. Private-sector hiring in ADP’s April survey rose only 62,000, roughly half of Wall Street’s forecast and barely one-third of March’s pace. The same uncertainty is seeping into small-business sentiment: the NFIB optimism index fell to 95.8 in April, well below its long-run average of 98, as owners shelved expansion plans and reported the weakest hiring intentions since the pandemic. As NFIB’s Bill Dunkelberg put it, “uncertainty is the tax they can’t deduct.”

Housing, which normally benefits from rate-cut hopes when inflation cools, isn’t escaping either. Inventory is finally rising, up 16% versus prepandemic levels, but mortgage rates near 6.75% and shaky consumer confidence have turned the spring selling season into a “dud.” Builders in the Southwest are dangling rate buydowns, and sellers from Florida condos to Texas colonials are throwing in concessions, yet buyers remain on the sidelines. The fear: a tariff-driven cost spike could hit just as a purchase closes, saddling new owners with higher appliance or renovation bills.

Against that backdrop, Monday’s 90-day tariff cease-fire with Beijing looked like welcome relief, U.S. effective duties on Chinese goods will drop to roughly 39% from what Treasury called “embargo-like” levels. Yet, as the WSJ’s Greg Ip noted, the path to this “sensible” pause has been anything but: allies such as Britain are still staring at the same 10% levy China now enjoys, and smaller trading partners that already cooperated on fentanyl or trans-shipping concerns remain under tougher penalties. For companies, the message is that trade policy can swing overnight, so capital-spending and hiring plans need a higher margin of safety.

Investors, then, face a tale of two economies. The household side still benefits from disinflation and a sturdy labor market; the business side is already acting as if a slowdown is at hand. In practice that means headline data will stay noisy, good CPI prints, weak housing turnover, solid headline payrolls but thinning help-wanted ads, and markets will whip around each new tariff headline. The prudent takeaway is less about predicting the next policy twist and more about stress-testing portfolios and budgets for a world where costs and confidence can shift faster than the official statistics. Uncertainty, after all, has become the most reliable leading indicator of 2025.

Chart of the Week: Time, Risk, and Perspective, Understanding Performance in Context

Few snapshots are as misleading as a year-to-date leaderboard taken in isolation. Since the first trading day of 2025 the S&P 500 has inched lower while the “Magnificent Seven”, Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla, have fallen twice as far. Look only at that slice and the lesson seems obvious: mega-cap tech is finally cracking and broad diversification is the safer bet. The first chart below, “Same Stocks, Different Story: YTD 2025 the Mag 7 Lag the S&P 500,” drives the point home, plotting cumulative returns from 2 Jan 2025 to 12 May 2025 and showing the tech cohort under water by roughly six percentage points.

Scroll one screen and the narrative flips. Extend the horizon to include the prior year and the Mag 7’s stumble looks more like a breather after a sprint: from 1 Jan 2024 through the most recent close the basket is still up more than 60 percent, trouncing the S&P 500’s mid-20s gain. The second graphic, “Context Is Everything: 2024-2025 Cumulative Returns”, makes that contrast explicit. What appeared to be evidence of structural weakness is, with a wider lens, merely a give-back of last year’s euphoric AI-driven rally. Time-frame roulette distorts more investment decisions than any earnings miss or policy headline; the cure is to check multiple durations before drawing conclusions.

Perspective, however, should not be confused with complacency. The same turbo-charged upside that lifted the Mag 7 in 2024 amplifies drawdowns when sentiment sours. Statistically the group’s beta, its sensitivity to market swings, has hovered around 1.4 versus the S&P 500, meaning a 1 percent move in the index tends to translate into a 1.4 percent move for these stocks in the same direction. That higher “gear ratio” can accelerate wealth creation, but it also demands disciplined position sizing and periodic rebalancing. The lesson from the two charts is therefore two-fold: zoom out before judging performance, and remember that outsized returns ride shotgun with outsized risk.

Beyond Bias: Projection Bias - Why You Think You’ll Always Want the Same Things

Projection bias is the tendency to assume that our current preferences, emotions, and behaviors will remain constant into the future. First identified in behavioral economics by Loewenstein, O’Donoghue, and Rabin (2003), this bias explains why people overestimate how much they’ll enjoy future purchases, persist with short-term emotional decisions, or misjudge how their tastes will evolve. In investing, it can lead to extreme misallocations. Investors panicking during downturns might shift entirely to cash or bonds, convinced they’ll always be this risk-averse. Others might overconsume in the present, buying the “perfect” house or gear for a hobby they later abandon, because they wrongly believe their interests won’t change. Yet over decades, our values, passions, and even personalities shift. Research from Roberts and Mroczek (2008) shows that major personality traits change more between ages 20 and 40 than they do after 50, even though most people believe they are “done changing” by early adulthood.

The antidote to projection bias is humility about the future, and flexibility in how we treat our money. Because money is fungible, dollars you save today don’t need to match your present tastes. They can fund your future self’s needs, even ones you can’t yet imagine. Instead of buying everything that feels urgent now, view saving as a hedge against your own uncertainty. One useful mental model comes from Hal Hershfield’s research at UCLA, which shows that people who vividly picture their future selves tend to save more. Hershfield and colleagues (2011) found that viewing aged images of oneself increased retirement contributions, because it closed the psychological gap between present-you and future-you. If you want to counter projection bias, don’t just forecast the future. Visualize it. Recognize that your future self may not want what you want now, and give them the optionality to decide. That’s the real power of saving.

Building Wealth: The Portfolio of Meaning - Investing in Non-Financial Assets That Pay Psychological Dividends

When most people think about building wealth, they picture a growing investment account. But some of the highest-yield assets in life don’t show up on a balance sheet. Research consistently shows that time, health, autonomy, and close relationships contribute more to long-term life satisfaction than income alone (Diener & Seligman, 2004; Kahneman & Deaton, 2010). Structuring your life like a portfolio means recognizing these areas as capital you can grow. Time spent cultivating physical health through regular exercise, for example, improves cognitive function and emotional resilience well into old age (Ratey, 2008). Investing in autonomy, through skill-building, flexible work arrangements, or reducing dependency on volatile income sources, buys you psychological freedom, even in times of uncertainty. These aren’t luxuries; they’re assets that compound.

The best part is that these investments don’t require significant capital. A one-hour weekly walk with a close friend may do more for your emotional well-being than any financial windfall, especially as loneliness becomes a growing public health issue (Holt-Lunstad et al., 2015). Hobbies that foster flow, deep engagement in a task, can act as both a mental release valve and a source of personal pride, providing ongoing returns in self-esteem and identity (Csikszentmihalyi, 1990). Even something as simple as keeping one day of your week unscheduled can restore a sense of agency that improves decision-making across all domains. In short, your real portfolio isn’t just financial, it’s functional. And like any good investor, the key is diversification and intentional rebalancing toward what actually matters.

Add to your Toolbelt

Take control of your financial future with Rainier FM, your AI-powered financial planning companion. FM stands for Financial Model, and that’s exactly what this app delivers: optimized, data-driven financial plans tailored to your goals. Using advanced optimization techniques and AI-driven insights, Rainier FM helps users navigate everything from retirement planning to wealth building with confidence. Pricing reflects the cost of running the service, but I’m actively gathering feedback to refine and improve it. Here’s an example of an insight this app can help you uncover.

If this sounds like something you’d find valuable, feel free to reach out or sign up, I’d love to hear what you think as I continue developing the platform!

Historical Perspective: The 1974 Trust Crisis - When Americans Lost Faith in Institutions

By the spring of 1974, America found itself in a moment of profound disillusionment. Watergate hearings played on living room televisions, inflation surged into double digits, and gas lines snaked through neighborhoods as the oil embargo sent shockwaves through the economy. That year, consumer confidence hit its lowest point since records began. According to the University of Michigan’s Survey of Consumers, sentiment plunged to levels that wouldn’t be revisited until the depths of the COVID-19 pandemic nearly 50 years later (Curtin, 2020). Trust in government, corporations, and media collapsed in tandem, not just because of policy failures, but because Americans felt the social contract itself had broken.

The loss of institutional trust didn’t just show up in polls, it reshaped economic behavior. Gold, long dormant in the public imagination, surged in price as ordinary citizens sought something tangible amid the chaos. In 1971, gold had just been uncoupled from the U.S. dollar by President Nixon, effectively ending the Bretton Woods system. By 1974, it had become legal once again for Americans to own bullion, and they rushed to buy it. The metal’s price soared from $65/oz in 1972 to over $180/oz by 1975 (World Gold Council, 2021). Meanwhile, anecdotal reports of hoarding, from canned goods to ammunition, began surfacing as fear over price controls, shortages, and economic collapse circulated through households and headlines.

The crisis also fractured politics. Gerald Ford’s attempt to restore confidence with the “Whip Inflation Now” campaign, a branding effort that included buttons, slogans, and public appeals to thrift, was broadly mocked. No clear policy solution emerged. Monetary tightening from the Federal Reserve was met with pushback from a public already weary of recession. With inflation still surging and the stock market down nearly 45% from its 1973 high, many Americans withdrew not just from markets, but from civic engagement. The 1974 midterms delivered sweeping losses to Nixon-aligned Republicans, but few felt optimistic about the future. In retrospect, this wasn’t merely a moment of economic stress, it was a psychological regime shift. Americans began to internalize that stability wasn’t guaranteed and that leadership, whether political or economic, could fail them.

This history matters now because similar forces are again eroding public trust. Surveys from Pew and Gallup show declining confidence in banks, the media, and even the Federal Reserve. The appeal of crypto, gold, and decentralized systems is rooted in the same mindset that drove Americans to bullion shops and bunkers in the 1970s: a belief that centralized institutions no longer serve the average person. For investors, this has two implications. First, narrative and trust cycles can drive markets as powerfully as earnings or rates, sometimes more so. Second, preparing for volatility is not just about inflation hedges or portfolio allocations, but understanding when the public mood shifts from belief to skepticism. The 1974 trust crisis was not just a financial downturn; it was a collapse in consensus. And consensus, once lost, rarely returns quickly.

Works Cited

Curtin, Richard. (2020). Consumer Sentiment and the Coronavirus. University of Michigan Surveys of Consumers.

World Gold Council. (2021). Historical Gold Prices 1971–2021.

Pew Research Center. (2023). Public Trust in Government: 1958–2023. https://www.pewresearch.org

Gallup. (2022). Confidence in Institutions. https://news.gallup.com/poll/1597/confidence-institutions.aspx

Blinder, Alan. (1987). Hard Heads, Soft Hearts: Tough-minded Economics for a Just Society. Addison-Wesley.

Literature Review: Action vs. Attention - How AI Signals Shape Human Decisions

As AI systems increasingly assist humans in decision-making across finance, medicine, and law, a quiet design choice looms large: should these systems tell people what to do (action signals) or merely highlight where to focus (attention signals)? A recent study by Poulidis, Ge, Bastani, and Bastani (2024) tackles this head-on using an ingenious testbed: chess. In this high-stakes, time-pressured, and cognitively rich environment, they conducted a large-scale randomized controlled trial involving 276 players,i ncluding 36 titled experts, who played 2,484 games under three conditions: no AI help, attention signals, and action signals. The design allowed them to measure not only how performance changed, but why it changed, offering critical insights for designers of decision support tools in any domain where human-AI collaboration is the norm.

Their findings were both intuitive and surprising. Action signals, explicitly telling the player the optimal move, were more powerful in the moment, producing the largest gains in move accuracy and game results. But these signals came with a cost. Players who received action signals often made worse decisions on subsequent moves, having followed the AI into unfamiliar territory without understanding the reasoning behind the suggestion. In contrast, attention signals, alerts that a critical moment had arrived, without saying what to do, required more effort but delivered more sustainable results. These nudges caused players to think harder in the moment and, intriguingly, improved the quality of moves even after the signal was gone. This “spillover effect” suggests that attention signals encourage deeper engagement and learning, a finding that parallels research in psychology showing that effortful retrieval strengthens future memory (Roediger & Karpicke, 2006).

The study’s method is especially strong. The use of chess as a domain offers rare analytical precision: modern engines like Stockfish 15.1 can quantify the exact value of every move in centipawns (1/100 of a pawn), allowing researchers to rigorously define a “critical state” (where the best move is at least 60 centipawns better than the next best). By restricting interventions to these states, the researchers ensured that AI help was both needed and consequential. The randomized within-subjects design helped control for individual differences, while post-game surveys offered insights into how players felt about each kind of signal. Strikingly, players perceived attention signals to be more helpful than they actually were, and described action signals as reducing their sense of agency, mirroring research by Dietvorst et al. (2015) on algorithm aversion, where people resist even high-performing algorithms when they feel disempowered.

Despite its rigor, the study isn’t without limitations. Chess is a constrained environment with clear rules and defined outcomes, unlike messy real-world domains like healthcare or finance. One might argue that in investing, where uncertainty, ambiguity, and incomplete information dominate, the clean distinction between action and attention signals is blurrier. Still, the metaphor holds. An AI that tells an investor “buy this stock now” may produce faster results, but it risks disengagement or blind trust. An AI that says “pay attention to this valuation signal” invites effort and potentially deeper understanding. As in the study, effort is the cost, but also the key to long-term improvement. These dynamics echo dual-process theories of cognition (Kahneman, 2011), which suggest that while shortcuts (System 1) are fast, effortful thinking (System 2) is more durable when the stakes are high.

For investors, the takeaway is profound. As AI-driven tools become embedded in platforms, from robo-advisors to earnings prediction models, the choice between action and attention signals affects not just outcomes but behavior. Blindly following a “buy” signal may yield quick gains, but leaves users vulnerable in new conditions. Systems that preserve agency, foster curiosity, and help people learn may yield better results over time, even if they seem less efficient in the short run. In a world awash with AI-generated advice, the investor who stays engaged, like the chess player who pauses to think in response to an attention signal, may ultimately outperform.

Curious about money, investing, or the economy?

I occasionally answer reader questions in the newsletter, no jargon, just thoughtful, practical insight. If something’s on your mind, tap the button below to send it in anonymously.

Programming Note: As summer picks up, I’ll be shifting away from a fixed publishing schedule and instead posting when time allows. My goal is to still publish at least every two weeks, though the exact day may vary. These are a lot of fun to put together, but they do take time!