2 - Rightsizing spending

Effective strategies for reducing expenses and maximizing savings

Now that we've discussed how much to save in the last article, the next important topic to address is how to think about the leftover money that will be spent. This article will present a few rules of thumb and strategies that I use, as well as those recommended by others, to help curb spending. As a reminder, this article is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Key points

Managing housing costs is crucial. Aim to keep these expenses below 25% of your net or gross income.

Adopting a reverse budget that prioritizes saving and investing for needs, while spending the remaining amount, can enhance your net worth over time.

Implementing guardrails for your spending, such as the 10% rule and removing credit cards, can lead to improved spending habits.

The first aspect I'll address is housing costs, as this is typically the largest monthly expense people have. I use a scale to determine if I'm spending a healthy amount on housing. Although you can see the math in this calculator, you should generally spend between 25 and 33% of your gross or net salary on housing. Calculate what all four of those numbers are (25% of gross, 25% of net, etc) and consider the lowest number “healthy” while each additional number is a threshold for concern. Consider this seriously when making your next housing decision, as you will be locked into that situation for a long period of time—usually at least one year for renters.

It's worth noting that homeowners paying a mortgage will need to do additional calculations to determine their actual “unrecoverable” cost of housing. Unrecoverable costs are dollars you will never get back. For rent, 100% of what you pay is unrecoverable, but for homeownership, the math is a bit different. A simple method to calculate your unrecoverable costs as a homeowner is to take the value of your home, multiply it by 0.05 (5%), and then divide by 12 to convert it into a monthly figure. We'll discuss why this works in the future, but for now, here's a simplified explanation.

Addressing housing costs will significantly help the rest of your finances. Using the same example as in the last article, let's say you have an $80,000 gross salary and are 30 years old. You're saving 30% of your gross salary and paying 25% in taxes. Of the remaining 45% used for consumption, we can use a reverse budget. This method prioritizes savings and forces you to live on the leftover amount. Instead of approaching your finances as "I have this much leftover to save," shift your mindset to "I have this much leftover to spend."

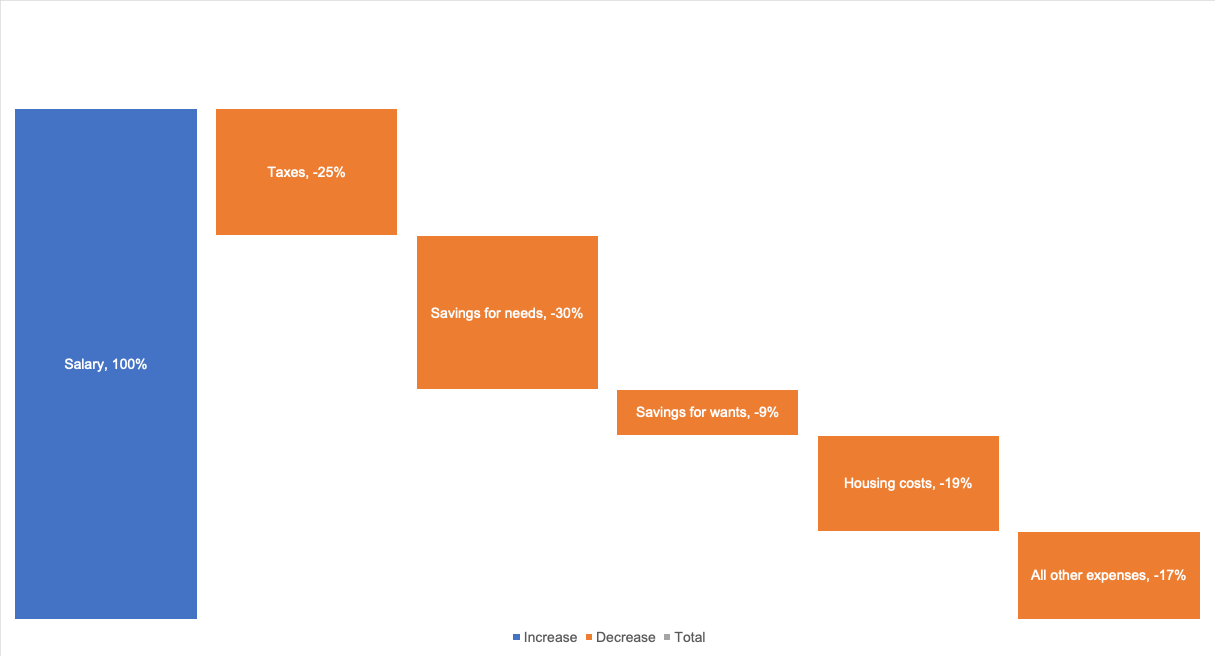

One way to do this is to allocate about 20% of your take-home pay to a separate high-interest account for "wants," which should be designated for non-recurring items like a new iPhone or bike. Using our previous examples, here's what your monthly income waterfall would look like:

Expenses as a percentage of your gross salary

I've presented this in percentage terms to help you visualize how it would apply to your situation. Of course, you should adjust this based on your life circumstances. This is not advice; it's simply my approach to spending and saving, which has proven to be a helpful framework for increasing savings.

What are some other boundaries or guardrails for purchases? A useful rule is to never spend more than 10% of your net worth on an item. For example, if your net worth is $100,000, you shouldn't purchase a car worth more than $10,000. Shift your mindset from "What are the monthly payments, and can I afford them?" to "What is the total value of this car, iPhone, or any other item, and what proportion of my total net worth does it represent?" This approach will help you avoid overspending. Additionally, having a separate savings account for "wants" will indicate when you can afford these wants. Note that you shouldn't use your "wants" savings account for emergencies, such as needing a new transmission; instead, you can use your emergency fund for those situations and replenish it using the savings strategy outlined in my previous article.

Lastly, if you're serious about managing your finances in a healthier way, it's crucial to become comfortable with the idea that you can't always do something because it's beyond your budget. You may want to practice phrases like "I can't afford that right now," allowing them to influence your decision-making. So much of financial management is really just psychology. If you tend to overspend at restaurants, you must actually skip nights out to confirm this approach is working. Another excellent idea, if you have a credit card, is to cut it up or at least remove it from your wallet and rely on a debit card instead. Studies show that people are more inclined to spend more money when using credit cards, and any unpaid debt accruing interest can erode your net worth. Credit cards have their place in a healthy financial plan, but we will discuss that later.