Market Giants, Housing Stalemates, and Risky Innovations: This Week’s Financial Realities

Exploring the dominance of the ‘Magnificent 7,’ the housing market freeze, and the gamblification of trading apps.

This week I’m trying out something new. I’m breaking everything up by section. Let me know if you like this! Today’s article takes 9 minutes to read.

Key Takeaways:

1. Market Power Concentration: The “Magnificent 7” drove 21.7% earnings growth in Q4 2024, far outpacing the S&P 500’s 9.7% growth outside these firms, highlighting increasing reliance on a few dominant companies.

2. Housing Market Freeze: Home sales in 2024 hit a 30-year low at 4.06 million, with mortgage rates between 6%-8% locking homeowners into existing low-rate mortgages, restricting supply and market activity.

3. Insurance Risks Mounting: California’s Fair Plan carries $458 billion in exposure but holds just $2.7 billion in reserves, as capped premiums force private insurers out, leaving taxpayers to bear disaster costs.

4. Gamified Trading Dangers: Apps like Robinhood use gamification tactics like confetti and leaderboards to drive risky trading, increasing activity by up to 12% and disproportionately affecting vulnerable investors.

5. Policy Gaps Fuel Instability: Suppressed risk pricing in insurance, housing, and markets leads to inefficiencies, taxpayer burdens, and market imbalances, underscoring the need for stronger regulatory frameworks.

In the news

The disparity between the “Magnificent 7” and the rest of the S&P 500 reveals an accelerating concentration of market power. In Q4 2024, these seven companies collectively posted 21.7% year-over-year earnings growth, compared to 9.7% for the remaining 493 companies. This gap demonstrates the outsized role these firms—like NVIDIA, Amazon, and Alphabet—play in driving aggregate earnings. Their dominance isn’t a short-term trend; projections show the “Magnificent 7” outpacing the broader market’s earnings growth by nearly double in two of the next four quarters. This increasing reliance on a handful of companies for market performance mirrors global patterns, as concentrated corporate power shapes economic landscapes across industries and countries.

Meanwhile, the housing market reflects the devastating effects of path dependence and policy-driven constraints. U.S. home sales in 2024 plummeted to 4.06 million, the lowest level since 1995, despite a population 25% larger than during that period. Mortgage rates hovering between 6% and 8% since late 2022 have locked homeowners into low-rate mortgages, disincentivizing moves and freezing supply. These elevated costs don’t just restrict buyer activity; they create ripple effects, hobbling mortgage lenders and real-estate markets alike. As housing affordability remains elusive, it’s crucial to remember that while markets may appear stagnant, history suggests rebounds are likely, as seen in the years following the mid-1990s housing slump.

Shifting focus to insurance, California exemplifies the breakdown of risk management when premiums fail to reflect true costs. The state-run Fair Plan now carries $458 billion in exposure but holds just $2.5 billion in reinsurance and $200 million in cash—a precarious mismatch. Regulatory limits on premiums have forced private insurers to exit, leaving homeowners vulnerable. The core issue is simple yet overlooked: risk cannot be eliminated; it can only be redistributed. When premiums are artificially suppressed, the resulting gaps must be covered by taxpayers or result in financial ruin. This dynamic extends to health insurance, where Affordable Care Act provisions cap premiums for high-risk individuals, further transferring costs across the system without addressing the underlying risks.

Chart of the week

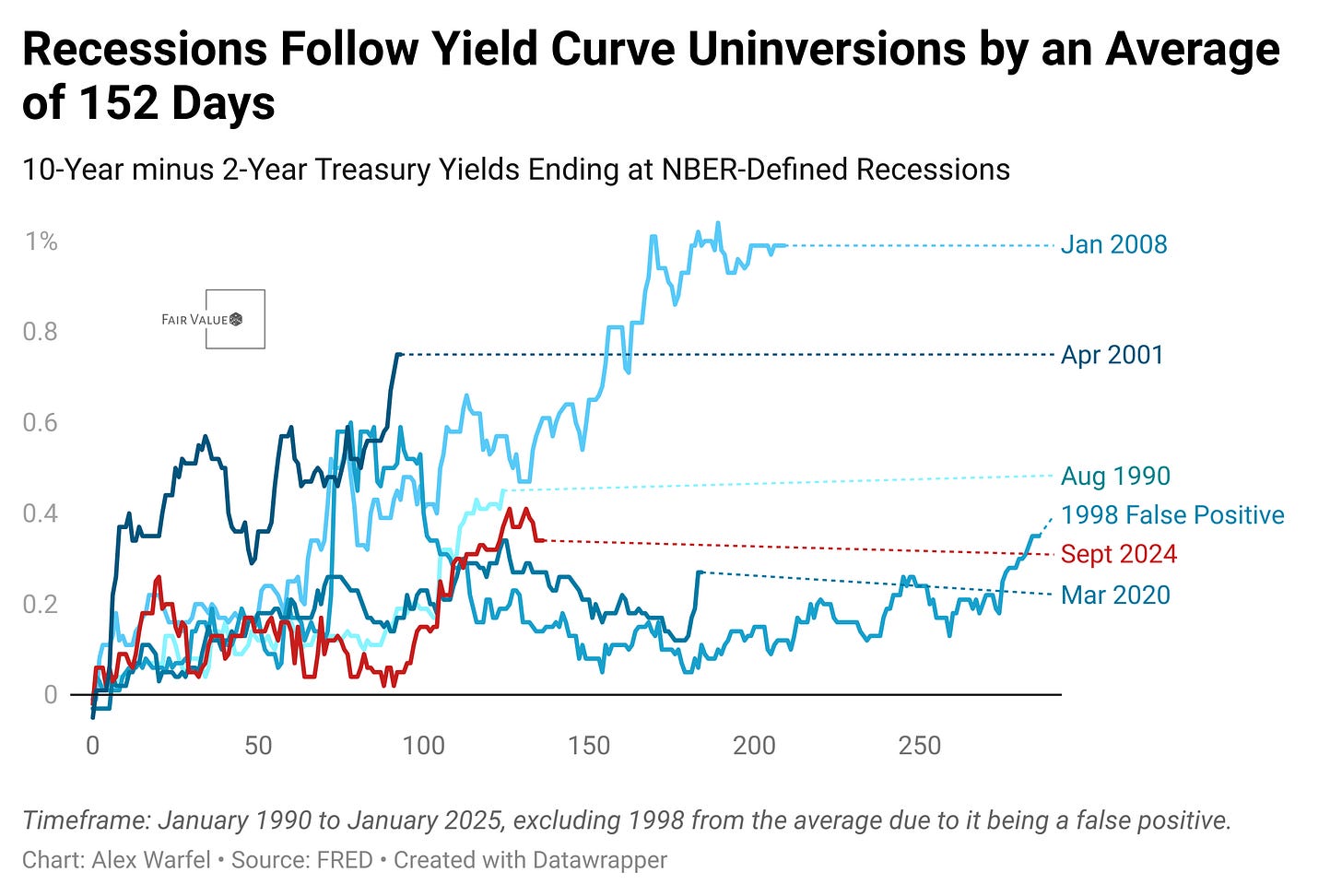

A yield curve inversion occurs when short-term interest rates become higher than long-term interest rates, which is the opposite of the typical relationship. Normally, investors demand higher returns for longer-term investments because of the increased risk over time, resulting in an upward-sloping yield curve. However, when the curve inverts, it signals that investors are expecting weaker economic growth or even a recession. This is because they anticipate that central banks will need to lower short-term rates in the future to combat an economic slowdown, leading them to seek the safety of long-term bonds, which pushes their yields lower. Historically, yield curve inversions have been a reliable predictor of recessions, as they often reflect growing uncertainty about the economy.

I’ve been closely following the yield curve, especially since its recent uninversion. Curious about the typical timeframe between uninversion and a recession, I found that it historically takes an average of 152 days. As of now, it’s been about 136 days since the most recent uninversion, suggesting there’s still a possibility of a recession based on this indicator. Of course, some past recessions were driven by external factors, such as COVID-19, which aren’t directly tied to the yield curve.

Thinking Beyond Bias

Confirmation bias is when people focus only on information that supports what they already believe while ignoring facts that might challenge their views. In personal finance, this can happen when someone is convinced a particular investment, like a stock or cryptocurrency, is a great choice. They might only pay attention to positive news about it and ignore warning signs, like falling earnings or regulatory risks. For example, if you believe buying real estate is always the best way to build wealth, you might overlook data showing that home values can decline during certain market cycles or that maintenance costs eat into returns.

To combat confirmation bias, it’s important to seek out different perspectives and challenge your assumptions. For instance, if you think a specific stock is a guaranteed winner, try looking at critical analyses or reading reports from people who disagree. Diversifying your sources of information is key—read books, follow credible financial experts with different opinions, and look at data objectively. Another helpful strategy is to ask yourself, “What could go wrong with this decision?” This helps you see potential risks and make more balanced financial choices. Using a trusted financial advisor or running your plans by someone with no emotional attachment to your investments can also help you avoid falling into this trap.

Building Wealth: Tips and Tools

I just came across a fascinating formula for figuring out what your net worth “should” be at every age, and it’s simple. The formula is: (Salary × Age) ÷ (10 + MAX(Number of Years Until You’re Age 40, 0)). It works by combining your income, age, and how far away you are from turning 40. For example, if you’re 30 years old and earning $60,000 a year, you’d calculate your expected net worth as (60,000 × 30) ÷ (10 + 10) = $90,000. If you’re already past 40, the formula simplifies because that second part becomes zero, making it easier to gauge your progress.

This formula is great because it gives people a clear, age-adjusted goal for building wealth. It’s especially useful for those who aren’t sure if they’re saving enough or if they’re on track financially. Instead of just guessing, you can plug in your numbers and get a realistic benchmark. Of course, it’s not perfect—it doesn’t account for factors like debt, cost of living, or big life changes. But as a starting point, it’s a helpful tool for getting a sense of where you stand in your wealth-building journey and motivating yourself to save more for the future.

Historical perspective

The first financial derivatives were developed centuries ago as tools to manage risk and stabilize prices, long before the complexities of today’s financial markets existed. One of the earliest examples comes from ancient Mesopotamia around 1750 BCE, where farmers and merchants used basic agreements resembling modern futures contracts. In these agreements, farmers could lock in prices for their crops before harvest, ensuring they weren’t ruined by a bad season or a sudden price drop. This provided both sides—buyers and sellers—with predictability and security in a world where agriculture was central to the economy.

Derivatives as we know them started taking shape in the 17th century, particularly in Japan, where rice traders in Osaka used what were called “rice tickets.” These were agreements to buy or sell rice at a set price in the future, allowing traders to hedge against fluctuating prices. By the 18th century, these agreements became so popular that they formed the basis of Japan’s first organized exchange, the Dojima Rice Market. This market became a prototype for modern derivatives exchanges, showing how these tools could be formalized to reduce risks in volatile markets.

The modern era of financial derivatives began in the mid-19th century in the United States with the establishment of the Chicago Board of Trade (CBOT) in 1848. This exchange initially focused on agriculture, with farmers and grain merchants using futures contracts to lock in prices for crops like wheat and corn. For example, a farmer could agree to sell wheat in six months at a fixed price, which protected them from the risk of prices dropping during the harvest. At the same time, buyers were protected against price spikes caused by shortages. This innovation became critical to stabilizing food markets in the rapidly industrializing U.S. economy.

Over time, derivatives evolved beyond agriculture into other industries, including energy, finance, and commodities like oil and metals. The 1970s were a turning point, as financial derivatives emerged to address the growing volatility of currency and interest rates after the collapse of the Bretton Woods system in 1971. Institutions like the Chicago Mercantile Exchange (CME) introduced currency futures in 1972 to help businesses manage exchange rate risks as global trade expanded. Shortly after, interest rate derivatives followed, allowing banks and investors to hedge against fluctuating borrowing costs.

Today, derivatives are a massive part of global finance, with trillions of dollars in contracts traded daily. They’re used for purposes far beyond their original intent, including speculation and leveraging investments. While derivatives have become more complex, their roots remain the same: tools to manage risk and bring stability to uncertain markets. From the rice markets of Osaka to today’s sophisticated exchanges, derivatives have evolved to meet the changing needs of economies across centuries.

Product focus

Take control of your financial future with Rainier FM, your AI-powered financial planning companion. Designed to make financial planning easier and more accessible for everyone, Rainier FM uses cutting-edge modeling and intelligent insights to create personalized plans tailored to your goals—whether you’re preparing for retirement, saving for a milestone, or building wealth with confidence. This app reflects a problem I’m passionate about solving: simplifying financial planning to empower individuals like you. By checking out Rainier FM, you’re not only exploring your financial potential but also supporting me in this mission as I continue developing the app—it’s still a work in progress, and your feedback is invaluable! Ready to get started? Login or register now!

Literature review: Hooked and Hustled: The Predatory Allure of Gamblified Finance

This study looks at how certain trading apps use “gamblification” to make investing feel more like a game. Researchers found that apps like Robinhood, Webull, and crypto exchanges add features such as confetti and leaderboards to increase user excitement. They also discovered that one in three people who trade rely mainly on “finfluencers,” or online financial influencers, when making money decisions. This means social media stars can have a big impact on how and when people trade stocks or cryptocurrency. There is a massive conflict of interest here as finfluencers can be paid to promote products like Robinhood and Coinbase.

A key part of the research involved a 2024 experiment done by the UK’s Financial Conduct Authority (FCA). In this experiment, over 9,000 people used a test trading platform with different “digital engagement practices,” such as prize draws and push notifications. The study showed that adding these gamified features caused some people to trade more often—by as much as 12%. It also found that people with lower financial knowledge, plus women and younger participants, were especially at risk of taking bigger financial chances.

The research also looked at the number of new trading accounts opened in the UK. Between early 2021 and 2024, about 2.47 million accounts were created on four main trading apps. This rapid jump shows how many more people are trying their luck with investing platforms, sometimes treating them like gambling or a game. The apps’ designs, with bright colors and instant rewards, often pushed users to trade quickly rather than think about the risks.

Another focus of the study was how certain design tricks resemble gambling, such as flashing lights or surprise bonuses. Many of these design tricks come from the casino world, where games are built to spark excitement and keep people playing. The study showed that people who already liked gambling were even more likely to get hooked on these trading apps. They often chased losses and made risky moves, like trading options or cryptocurrency without fully understanding the dangers.

Researchers also looked at ways to stop apps from taking advantage of vulnerable users. One idea is to enforce “responsible engagement” rules, where apps must warn users about high risks and limit game-like features that push rapid trading. The study suggests that laws covering gambling and consumer protection should address these issues, especially since so many younger investors get pulled in by games and social media hype. State laws in the U.S. and stricter rules in the UK could both serve as models for handling these problems.

Overall, the study points to a growing concern that trading platforms may be acting more like betting games than real financial services. By adding bright animations, points, and prizes, these apps encourage risky behavior and could cause major financial harm. The researchers call for clearer laws, more warnings, and increased oversight to keep people from being misled or harmed by this new blend of finance and fun.

I hope you liked today’s changes. There are a lot of things I’d like to write about, so I’m moving more towards a section based approach. Thank you so much for reading!