Job Growth Slows, Markets Rally, and Investors Keep Chasing the Past

This week’s deep dive explores the slowing but resilient job market, why past stock market gains don’t predict the future, the hidden psychology behind financial decisions, and how decades of governme

Today’s article takes 14 minutes to read. Typically I try to get these out on Mondays but this one took a little longer.

Key Takeaways

In the news: Job Growth Slows but Stays Strong – The U.S. economy added 143,000 jobs in January, below the 169,000 expected but still solid. Unemployment fell to 4%, beating forecasts of 4.1%. Prime-age employment (ages 25-54) hit 80.7%, a strong sign of labor market engagement.

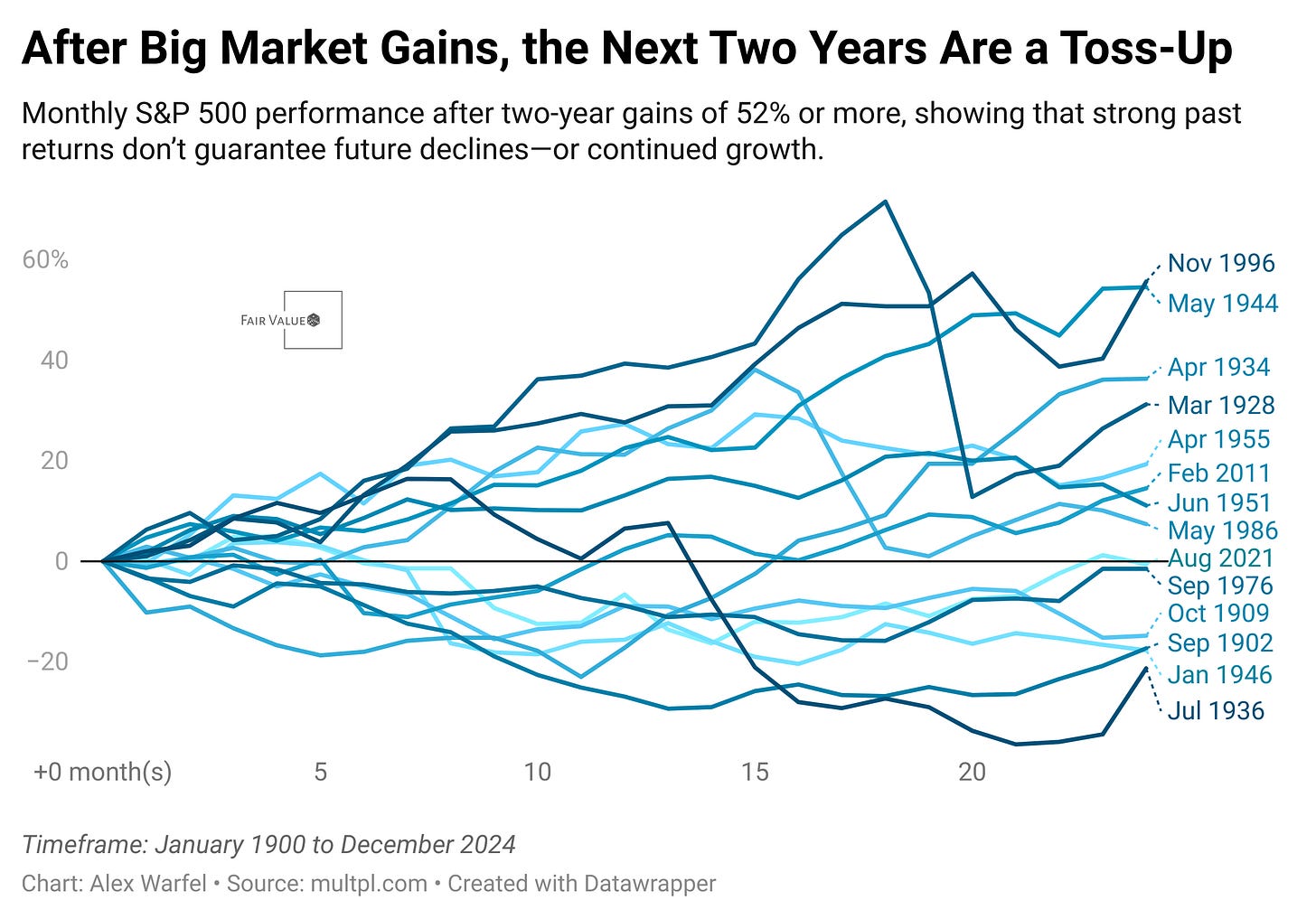

Chart of the week: Past Gains Don’t Predict Future Returns – The S&P 500 has gained 52% since February 2023, but history shows no clear pattern for the next two years. Research (Dimson, Marsh & Staunton, 2019) finds valuation metrics like the CAPE ratio (Campbell & Shiller, 1998) are better predictors than past price moves.

Beyond bias: The Stag Hunt & Financial Decisions – The stag hunt game theory model shows that trust and cooperation lead to higher rewards, but fear of betrayal leads to safer, lower returns. Studies (Ostrom, 1990) show repeated interactions increase cooperation, helping businesses and investors reduce risk with contracts and diversification.

Building wealth: Avoid Lifestyle Inflation – Living below your means is key to building wealth. Research (Dunn & Norton, 2013) shows higher spending doesn’t bring lasting happiness. Automating savings before spending improves financial discipline (Thaler, 2015).

Historical perspective: Presidential Efficiency Reforms – Presidents have long pushed for government efficiency. The Grace Commission (1982) proposed billions in cuts, but little changed. The National Performance Review (1993) cut jobs and streamlined operations. The Quicksilver Initiatives (2000s) expanded e-government, and Executive Order 13514 (2009) focused on sustainability. Now, DOGE (2025), led by Elon Musk, targets $1B in AI-driven cost cuts under Trump.

Literature review: Skill Beats Past Performance – A study by Essentia Analytics found no correlation (R² = 0.0023) between a portfolio’s past and future returns. However, investors with a Behavioral Alpha (BA) Score above 50 were 1.51 times more likely to outperform the following year. Skilled investors balance buying and selling better, unlike average investors who hold losers too long and sell winners too early (Akepanidtaworn et al., 2023).

In the news

The U.S. economy added 143,000 jobs in January, signaling a slowdown in hiring but maintaining a solid job market. While this figure was lower than the 169,000 jobs economists expected, the Labor Department’s revisions added 100,000 more jobs to the counts for November and December, suggesting previous hiring was stronger than initially reported. The unemployment rate fell to 4%, defying economists’ predictions that it would rise to 4.1%. Additionally, the share of prime-age workers (ages 25-54) in the labor force increased to 80.7%, a strong sign of labor market engagement. Despite the slowdown, layoffs remain near historic lows, and hiring continues across key industries like healthcare, retail, and government, although employment in mining and oil & gas extraction declined.

Beyond job growth, economic uncertainties loom as President Trump’s new policies on immigration and tariffs could significantly impact labor supply and business hiring. JPMorgan analysts warn that reduced immigration may slow payroll growth, while new import tariffs on Chinese, Canadian, Mexican, and EU goods could dampen trade and economic expansion. The Federal Reserve remains in a wait-and-see stance on interest rate cuts, closely watching labor market trends and inflation before making adjustments. Meanwhile, wages grew faster than expected, continuing to outpace inflation, a positive sign for worker purchasing power. However, downward revisions to past employment data indicate that 598,000 fewer jobs were created in the year ending March 2024 than previously reported. Despite these mixed signals, economists generally view the January jobs report as evidence of a cooling but still-resilient labor market.

Chart of the week

It’s easy to assume that after two years of strong stock market gains, the next two years must be rough. This belief comes from the idea of mean reversion, which suggests that everything eventually returns to its historical average. But in finance, this isn’t always true. Research from Dimson, Marsh, and Staunton (2019) shows that stock markets don’t follow a predictable pattern of boom and bust. While periods of extreme overvaluation can lead to corrections, markets can also continue rising if investor confidence, earnings growth, and economic conditions support higher prices. Looking at past S&P 500 data, after two-year gains of 52% or more, returns in the following 24 months have been all over the place—sometimes strong, sometimes weak, and sometimes flat. Why did I choose 52% as the benchmark, that is how much the S&P 500 has returned since February 2023. The key takeaway? Past performance alone doesn’t tell us what will happen next.

That said, valuation still matters when trying to assess future returns. Studies from Campbell and Shiller (1998) have shown that stock valuations, particularly metrics like the CAPE ratio, have a much stronger connection to long-term returns than past price trends. High valuations often indicate that investors have very optimistic expectations, and if those expectations aren’t met, future returns can disappoint. This doesn’t mean a crash is guaranteed, but it does mean investors should be cautious when valuations are stretched. The mistake many people make is relying only on past price performance to predict the future, ignoring the role of earnings, interest rates, and investor sentiment. Instead of assuming that a big rally means trouble ahead, it’s better to focus on whether stock prices are supported by real growth—or if they’re being fueled by hype.

Beyond bias

The stag hunt is a classic game theory model that illustrates the tension between cooperation and self-interest. It describes a situation where two hunters must choose between working together to hunt a stag, which provides a large reward but requires mutual cooperation, or acting alone to catch a rabbit, which is a safer but less rewarding option. The model highlights how trust and coordination are essential for achieving the best possible outcomes, but also how fear of betrayal can push people toward less optimal choices. This concept appears in many real-world situations, from business partnerships to investment strategies. For example, if two business partners invest fully in a new product, they stand to gain significantly—unless one backs out, leaving the other with losses. Research suggests that repeated interactions and strong reputations increase trust, making cooperation more likely over time (Ostrom, Governing the Commons, 1990).

Understanding the stag hunt can improve personal decision-making by clarifying when cooperation is the best choice and when independent action is wiser. The key is assessing whether mutual commitment is likely or if there’s a risk of defection. For example, two friends considering a business venture face a stag hunt scenario: if both fully commit, they have a strong chance of success, but if one hesitates, the other could suffer losses. This model encourages people to reduce uncertainty by securing safeguards—such as contracts, diversified investments, or alternative options—to prevent being left vulnerable. Game theory studies show that when people recognize they are in a stag hunt, they make better choices by strengthening trust, establishing clear agreements, and ensuring mutual accountability (Kollock, Social Dilemmas: The Anatomy of Cooperation, 1998). By applying these insights, individuals can navigate complex decisions with a greater understanding of risk and reward.

Building wealth

One of the simplest ways to build wealth is to anchor your lifestyle to a lower income level, even as your earnings grow. Many people fall into the trap of lifestyle inflation—spending more as they make more—without realizing how much this slows their ability to save and invest. A powerful psychological trick is to act as if you’re still earning your previous salary, even after a raise or bonus. For example, if you get a 10% salary increase, instead of upgrading your car or moving to a more expensive home, continue living on your previous income and invest the extra money. Research shows that people tend to mentally adjust to higher spending quickly, but they don’t feel the same lasting satisfaction from material upgrades (Dunn & Norton, Happy Money: The Science of Smarter Spending, 2013). By keeping expenses steady while income grows, you create a natural wealth-building system without feeling deprived.

Another way to build wealth using psychology is to reframe saving as an expense you must pay, rather than an optional activity. People naturally prioritize bills—rent, utilities, and debt payments—because not paying them has immediate consequences. By setting up an automatic transfer to savings or investments the same day you get paid, you trick your brain into treating it like another bill. Behavioral finance research shows that this method, known as “mental accounting,” helps people save more consistently because they never see the money as available for spending (Thaler, Misbehaving: The Making of Behavioral Economics, 2015). This approach removes the decision-making burden, making wealth accumulation feel effortless over time. The key is to automate the process, ensuring your financial future is built without requiring constant discipline.

Product focus

Take control of your financial future with Rainier FM—your AI-powered financial planning companion. FM stands for Financial Model, and that’s exactly what this app delivers: optimized, data-driven financial plans tailored to your goals. Using advanced optimization techniques and AI-driven insights, Rainier FM helps users navigate everything from retirement planning to wealth building with confidence. Pricing reflects the cost of running the service, but I’m actively gathering feedback to refine and improve it. If this sounds like something you’d find valuable, feel free to reach out or sign up—I’d love to hear what you think as I continue developing the platform!

Historical perspective: A History of Cutting Government Waste—With Mixed Results

For decades, U.S. presidents have launched efficiency initiatives aimed at cutting government waste, but their success has been mixed. Each effort has faced bureaucratic resistance, political obstacles, or unforeseen consequences that limited its impact. Yet, some initiatives have led to real reforms, proving that efficiency is possible—if only in small doses.

In 1982, President Ronald Reagan’s Grace Commission set out to uncover and eliminate wasteful government spending. Led by businessman J. Peter Grace, the commission conducted a two-year investigation and found over $400 billion in unnecessary spending. Some of its most shocking discoveries included $500 hammers, $7,600 coffee pots for military use, and overpriced travel expenses that rivaled luxury vacations. The report suggested 2,478 ways to cut costs, but Congress ignored most of them. A major reason? Many of the wasteful programs identified were protected by powerful lobbying interests, making reform politically risky. Even though Reagan supported the findings, he lacked the congressional backing to implement them fully. The commission’s legacy serves as an early example of how good intentions often collide with political reality.

In 1993, President Bill Clinton’s National Performance Review (NPR)—later renamed the National Partnership for Reinventing Government—took a more aggressive approach to efficiency. Spearheaded by Vice President Al Gore, the initiative eliminated 250,000 federal jobs, making it the largest reduction in federal employment since World War II. Unlike the Grace Commission, this effort had immediate, measurable impacts. The NPR also cut bureaucratic red tape, shut down obsolete field offices, and streamlined government services, saving billions in administrative costs. However, despite these efforts, total federal spending continued to grow. Additionally, some critics argued that cutting jobs led to weaker public services in critical areas like veterans’ healthcare and Social Security processing times.

In the early 2000s, President George W. Bush’s Quicksilver Initiatives took efficiency in a digital direction. His administration aimed to modernize government operations by expanding electronic services, such as online tax filing, e-government portals, and digital access to federal loans. While these initiatives did improve public access to government services, many Americans were shocked to learn that, at the time, the federal government was still processing millions of paper forms by hand, causing unnecessary delays. A push for automation followed, but government technology adoption remained slow, often lagging behind the private sector by years.

By 2009, President Barack Obama shifted the focus to sustainability with Executive Order 13514, which prioritized environmental efficiency in government operations. The order set aggressive targets to reduce federal energy use by 30% and required agencies to cut greenhouse gas emissions and improve fuel efficiency in government vehicles. While well-intentioned, some agencies spent more money complying with sustainability mandates than they saved in energy costs. For example, retrofitting federal buildings with energy-efficient upgrades required massive upfront investments, leading some critics to question whether the program delivered true cost savings or simply shifted spending priorities.

Now, in 2025, President Donald Trump’s Department of Government Efficiency (DOGE), led by Elon Musk, is taking a radically different approach. Instead of relying on manual audits and policy adjustments, DOGE is using AI-driven analytics to automate efficiency reviews across federal agencies. Musk has claimed that AI models have already identified $1 billion in potential cost savings, with plans to implement cuts in duplicative government programs, excessive contractor spending, and outdated administrative processes. Unlike past initiatives, which depended on human oversight, DOGE’s reliance on real-time AI monitoring could allow for continuous cost-cutting rather than one-time policy shifts. However, skepticism remains. Critics argue that automation could lead to job losses in government agencies and that AI-driven decisions might not account for the complexities of certain federal programs.

While each president’s approach to government efficiency has varied, the common goal has been to reduce waste and improve operations. History suggests that while efficiency efforts can yield real benefits, they often face resistance from entrenched interests, bureaucratic inertia, and political opposition. If DOGE succeeds where past efforts have struggled, it could redefine how federal agencies operate in the AI era. But if history is any guide, cutting government waste will always be a battle against the forces of politics, lobbying, and deeply ingrained inefficiencies.

Supporting research:

• Grace Commission. War on Waste: President’s Private Sector Survey on Cost Control. U.S. Government Printing Office, 1984.

• Gore, Al. Creating a Government that Works Better and Costs Less: The Report of the National Performance Review. U.S. Government Printing Office, 1993.

• U.S. Office of Management and Budget. Expanding E-Government: Partnering for a Results-Oriented Government. Executive Office of the President, 2002.

• Obama, Barack. Executive Order 13514: Federal Leadership in Environmental, Energy, and Economic Performance. The White House, 2009.

• Department of Government Efficiency. Federal Modernization and Budget Reduction Report. U.S. Government Printing Office, 2025.

• The Wall Street Journal. “Trump’s Government Efficiency Push: The Role of DOGE and Elon Musk.” The Wall Street Journal, 2025.

• Wired Magazine. “The AI-Driven Efficiency Plan Behind DOGE’s First Agenda.” Wired, 2025.

Literature review

I wanted to challenge by own beliefs this week and so I found a paper that demonstrates there is skill involved in investing, and it is not entirely random. I do like that this paper focuses on decision making though.

For decades, investors have relied on past performance to gauge the success of a fund or portfolio manager. But a new study challenges this common belief, showing that decision-making skill—not past returns—is a better predictor of future success. The research, conducted by Essentia Analytics, introduces the Behavioral Alpha (BA) Score, a metric that quantifies an investor’s ability to make well-timed and rational financial decisions. The findings suggest that historical returns offer little insight into future gains—in fact, the study found no statistical relationship (R² = 0.0023) between a portfolio’s returns in one year and its performance the following year. However, portfolios with a BA Score above 50 were 1.51 times more likely to have positive relative returns in the next year compared to those with a lower score. This suggests that investors who consistently make good decisions are more likely to outperform, not because they were lucky in the past, but because they possess real skill.

The study breaks down investment decision-making into seven key areas, including entry timing, position sizing, stock selection, scaling in/out, and exit timing. One of the most notable findings is that professional investors tend to be much better at buying stocks than selling them. The research confirms previous studies showing that investors often hold onto losing positions too long or sell winners too early, leading to suboptimal returns. This aligns with findings from Akepanidtaworn et al. (2023), which showed that selling decisions were more driven by heuristics and liquidity needs rather than careful analysis. In contrast, skilled investors—those with a high BA Score—demonstrated a more balanced approach to both buying and selling, leading to better portfolio outcomes.

These findings reinforce a growing body of research in behavioral finance that challenges the assumption that markets are purely efficient. Investors—whether amateurs or professionals—are prone to biases, from overconfidence to loss aversion, that can erode returns over time. For example, studies show that professional investors tend to overweight stocks that have performed well in the past, even though this does not necessarily predict future success (Antoniou & Mitali, 2023; Chang et al., 2017). The BA Score offers a way to measure and potentially correct these biases, giving investors a framework to refine their approach.

The implications extend beyond fund managers. Retail investors can apply these insights by focusing less on past performance and more on disciplined, process-driven investing. For example, rather than chasing past winners, investors could assess their own biases, analyze their decision-making process, and set clear rules for buying and selling. By developing a structured approach—one that prioritizes thoughtful decision-making over impulsive reactions—investors can improve their odds of long-term success. In a world where financial markets are increasingly complex and unpredictable, understanding and refining decision-making skills may be the most valuable asset an investor can have.