Build vs. Buy in the AI Era: Why “Just Rebuild Your SaaS” Is Harder Than It Sounds

AI can write the code. But code was never the expensive part.

Software stocks got hit this week, and the narrative was tidy: AI is so good now that companies will simply rebuild their subscription software internally. Why pay Monday.com $15 a seat when an LLM can spin up a project management tool in an afternoon?

It’s a compelling story. It’s also mostly wrong. or at least, it’s wrong about where the costs actually are.

I’m skeptical of this approach. Not because AI hasn’t made building software faster (it has), but because “building the first version” was never the hard part. The hard part, the expensive, grinding, unglamorous part, is everything that comes after.

The Hidden Costs of “Free”

Here’s the pattern I keep seeing. A company pays somewhere between $15 and $1,000 per month for a SaaS tool. Someone on the team says, “We could build this ourselves, especially now, with AI.” And sometimes they’re right. An LLM can generate a working prototype surprisingly fast.

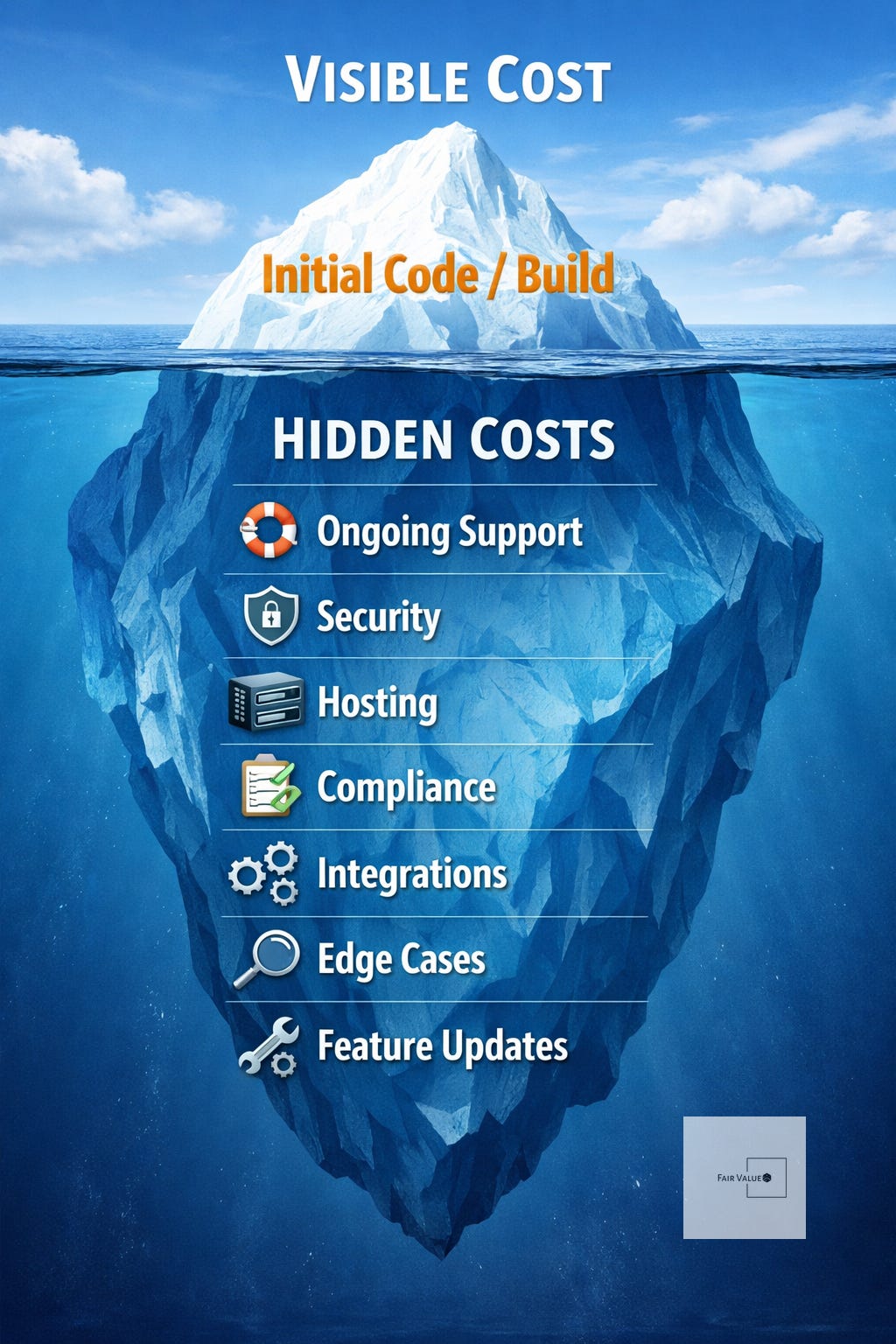

But then reality sets in. That prototype needs to talk to your CRM, your SSO provider, your data warehouse, and three other tools your team relies on. It needs to handle edge cases, the ones you don’t think about until they break at 2 AM. It needs security patches, uptime monitoring, compliance documentation, and someone to maintain it when the developer who built it moves on.

This is classic comparative advantage. A SaaS vendor spreads these costs across thousands of customers. Your internal tool bears them alone. When you do the math honestly, a company paying ~$50/seat/month for 100 users, about $60,000 a year, would need to compare that against the fully-loaded cost of at least one developer dedicated to building and maintaining the replacement. That’s often $150,000+ per year once you include salary, benefits, infrastructure, and the opportunity cost of not deploying that engineer on something that actually differentiates your business.

AI has dramatically reduced the cost of writing code. What it hasn’t reduced, at least not yet, is the cost of hosting, integrating, securing, supporting, and continuously improving software in a production environment. The first version is the visible tip of the iceberg. Everything beneath the waterline is where the real spend lives.

Where AI Actually Shifts the Line

None of this means AI doesn’t change the build-vs-buy calculus at all. It does, but in more targeted ways than the headline narrative suggests.

AI genuinely lowers the bar for certain categories of software: simple internal dashboards, lightweight workflow automation, one-off data tools, and internal apps that don’t need to be production-grade or customer-facing. If the tool is low-stakes, single-user or small-team, and doesn’t require deep integrations, building it yourself might now make sense where it didn’t before.

But for software that’s compliance-heavy, integration-dense, or mission-critical, think payroll, CRM, ERP, security tools, or anything that touches regulated data, the moat isn’t the code. It’s the years of edge-case handling, the audit trails, the API ecosystem, and the institutional knowledge baked into the product. AI doesn’t shortcut that. Not yet.

If I had to map it out, the spectrum looks something like this:

More buildable with AI: Internal dashboards, simple reporting tools, lightweight task trackers, data pipelines, internal chatbots.

Still firmly “buy”: Payroll/HR systems, CRM platforms, compliance/regulatory tools, ERP, anything requiring deep third-party integrations or contractual uptime guarantees.

The dividing line isn’t “can AI write this code?”, it’s “can my team own this system forever, and is that the best use of their time?”

The Smarter Threat: Unbundling, Not Rebuilding

Here’s what I think the market is actually (if clumsily) trying to price in: AI doesn’t replace SaaS by letting customers rebuild it. AI threatens SaaS by reducing seat counts.

If an AI agent handles 40% of the customer support tickets that used to require a human, the company doesn’t need as many Zendesk seats. If AI-generated analysis replaces some of the work a junior analyst did in a BI tool, the team might drop from 20 licenses to 12. The software itself isn’t going away, the number of humans who need to interact with it is shrinking.

That’s a pricing pressure story, not a replacement story. It’s real, it matters, and it’s a legitimate headwind for SaaS companies with seat-based pricing models. But it’s a fundamentally different (and slower) dynamic than “enterprises will just rebuild everything.”

For investors, the distinction matters. The “rebuild” narrative implies sudden, binary disruption, and it drove a sharp selloff. The “unbundling” thesis implies gradual margin and revenue pressure, which requires a different valuation framework and a different timeline.

What to Watch

If you’re evaluating software companies through this lens, here’s what I’d focus on:

Net revenue retention (NRR): Are existing customers spending more or less over time? If NRR holds above 110%+, customers aren’t leaving, they’re expanding. If it drops below 100%, the seat-compression story is real.

Integration depth: Companies whose products sit at the center of complex workflows (touching many other systems) have higher switching costs. That’s the moat.

Pricing model evolution: Watch for companies shifting from per-seat to usage-based or outcome-based pricing, that’s a signal they’re adapting to the AI-driven seat compression dynamic.

AI-native competitor traction: The bigger long-term risk isn’t internal rebuilds, it’s new entrants who build AI-first products that offer 80% of the functionality at 20% of the price. Watch startup funding and product launches in each software category.

The Bottom Line

AI changes the cost of the first version. It doesn’t change the cost of the hundredth update.

Build-vs-buy has always been a question of comparative advantage, not capability. Most companies are better off focusing their engineering talent on what differentiates them like their product, their data, their customer experience, and buying the commodity infrastructure around it. AI makes it easier to build, but it doesn’t make it smarter to build most of the time.

The selloff narrative that “everyone will just rebuild their SaaS for free”, is simpler than reality. And in markets, the gap between a simple narrative and a complex reality is often where the opportunity is.

This is general education and analysis, not personalized investment advice. Do your own research and consult a qualified professional before making investment decisions.