9 - Mapping out your financial health with personal balance sheets

Here we take a page from the business world and apply it to life to more accurately frame personal finance decisions and increase net worth over time.

Quick note, I am switching to sending these out Tuesdays instead of over the weekend. The next time you’ll hear from me is on May 23rd. I’m leaving you with a long post to hold you over until then!

Today, I’m going to talk about balance sheets. This may sound like a pretty boring topic, but it’s an incredibly useful framework for thinking about the future and is an essential tool in financial planning. Unfortunately, this is an assumption heavy exercise, but it’s worth doing, especially as things change in your life. This is a topic that you should cover with a financial advisor if you have one.

To request a topic anonymously, fill out this form. To reach me with questions, please email alexwarfel@gmail.com.

Key points:

Everything you own is funded by either equity or a liability.

We can adjust the mix of assets and liabilities to increase our net worth over time.

This concept can be extended to future assets and liabilities and allows us to gauge risk across time.

Asset funding sources

A balance sheet breaks up assets and liabilities + equity. First, some simple definitions:

Asset - Anything that you can sell.

Liability - Anything that you owe or will have to pay in the future.

Equity - Your outright ownership of assets.

Assets = Liabilities + Equity

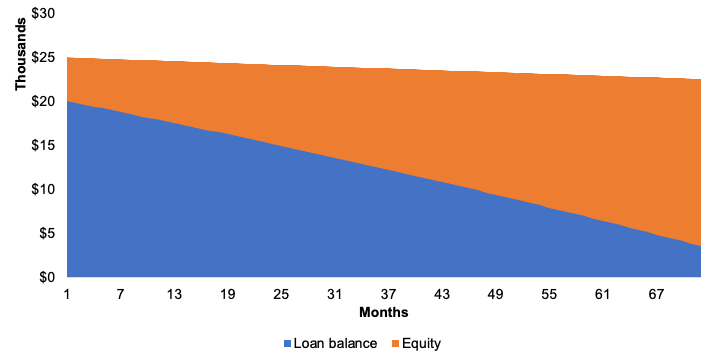

Another way to think about point 4 is that every asset is funded by either equity, a liability, or some combination of the two. Imagine you purchase a car with a loan from the dealership. The car is worth $25,000, you put down $5,000, which means the loan is for $20,000. It looks like this on the balance sheet:

We can see how this changes over time. Let’s stick with car purhcases. We’re going to start with the best case scenario. Pretend you’re purchasing a Jeep Wrangler, one of best vehicles when it comes to holding their value. Let’s say you also have the best credit score, affording you the lowest interest rate available of 4.75% on this new Jeep and you put 20% down. Your balance sheet for this vehicle will look like this over time:

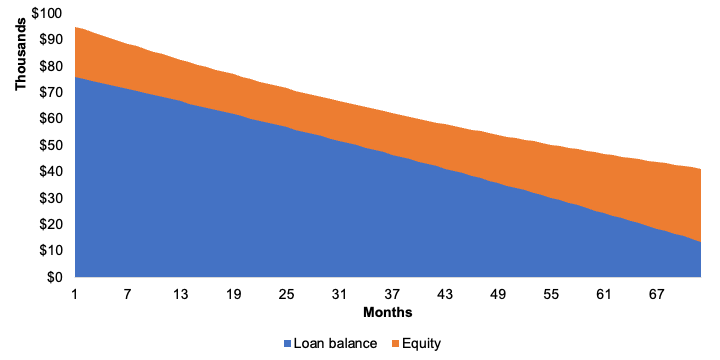

Notice that your equity, aka outright ownership of the vehicle, increases as the loan is paid down. Let’s take a look at a different car. Below is the BMW 740i, which has one of the worst depreciation rates over five years of any vehicle:

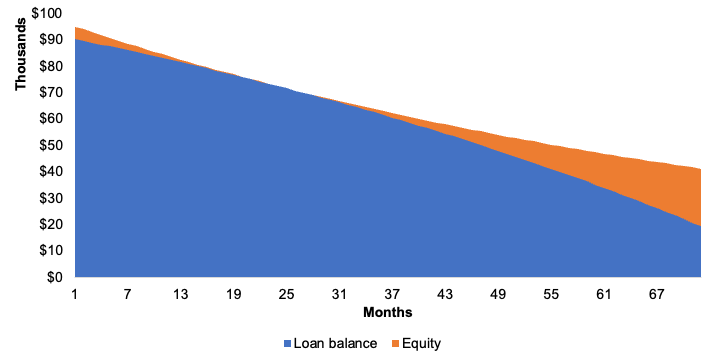

You can see that it’s much harder to build equity in this vehicle over time. Now, let’s move the interest rate on the loan from 4.75% to 12%, and reduce the down payment to 5%.

You actually end up underwater, or owing more than the car is worth, in the 22nd month before starting to recover your equity. If you were to sell the asset, you would still have some of the loan to pay for after the sale.

Financial balance sheets

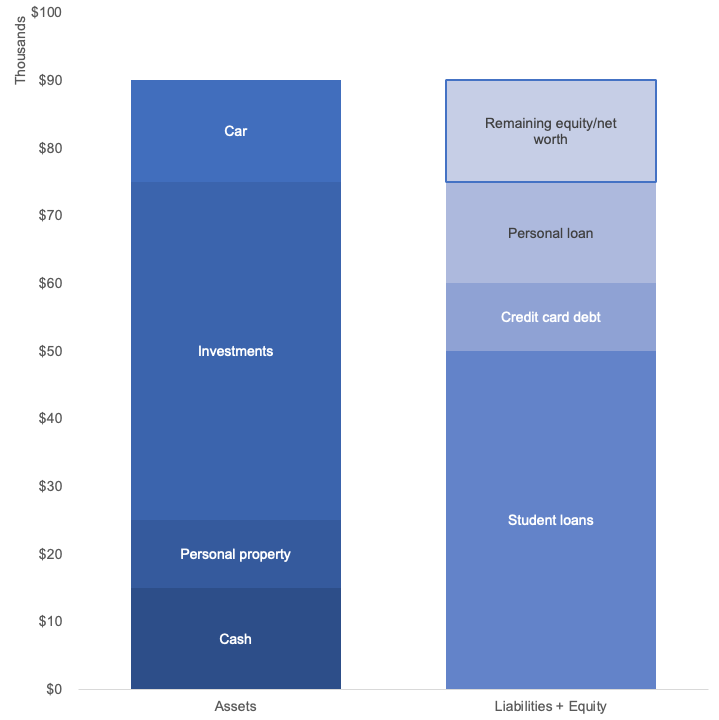

Furthermore, your entire financial picture works this way. This is what a hypothetical balance sheet looks like for a young professional:

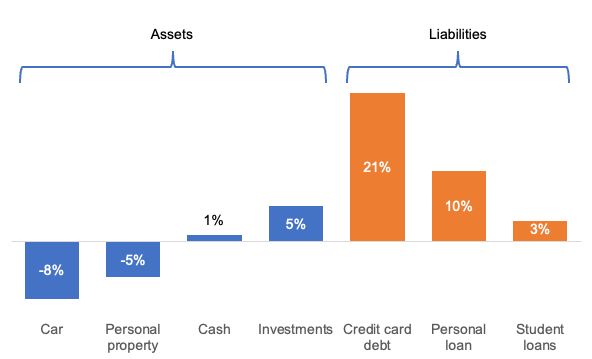

Your net worth is the top right square of this chart and your goal is to take actions that increase that square. You can either do that by paying down liabilities (aka debt), or increasing your assets. You can also do this over time by adjusting the type of assets and liabilities that are on your balance sheet. To do this, we need to first understand the rates of return on each of these. Here are some hypothetical rates:

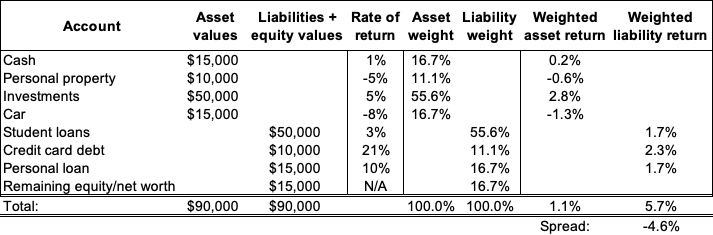

Now, if we weigh our assets’ returns by how much of our portfolio they make up, we get our overall return on assets. This tells us how quickly they are expanding vs our liabilities.

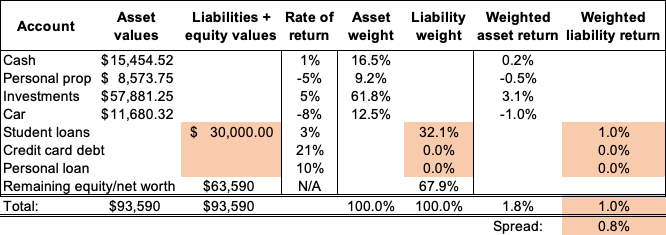

In the above example, the weighted return for our assets is 1.1% while our liabilities are costing us 5.7% per year. This means that we lose the spread between these two (4.6%) each year. To solve this, we want to pay down our debt, because there is no asset we can buy that yields more than the credit card debt or personal loan debt. In fact, if this person paid down $45,000 of debt principal over the next three years, this would be the new spread (accounting for increases in assets as well).

Now we’re in a much better financial situation. Our net worth is growing at a little less than 1% per year.

Extended balance sheets

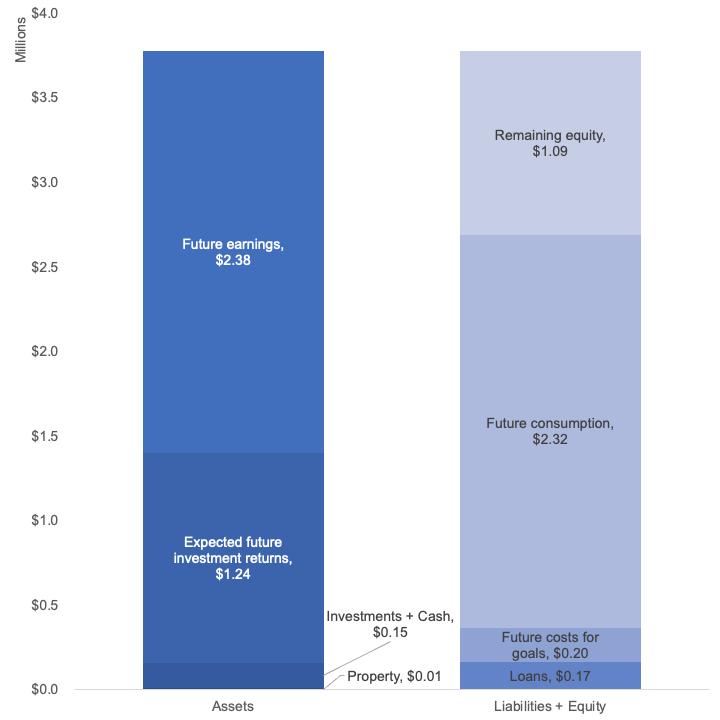

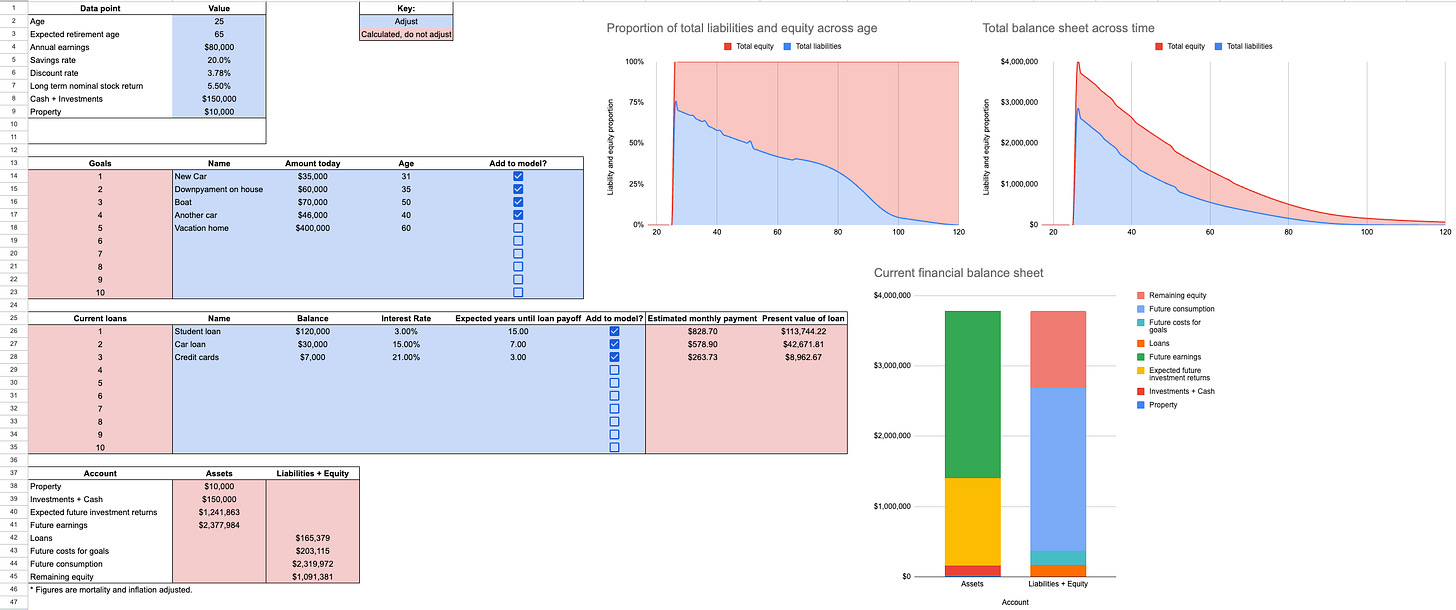

What we’ve talked about so far really just pertains to a single point in time and to financial assets that are owned and can be transferred to others, but there is one final piece of this puzzle that people should be aware of, and that’s extended assets and liabilities. These extended assets and liabilities can’t be transferred to other people and only impact you. Examples include access to a pension upon retirement or earnings you’ll get in the future from working a long career. These are quantified using discounting, which is the process of determining what the value of a series of cashflows in the future is. Here is what the extended balance sheet of a young professional with a few financial goals, a 20% savings rate, and expected retirement at age 65 looks like. These numbers account for both mortality and inflation. Consumption refers to anything that isn’t saved, aka consumed.

Notice that cash, investments, and personal property make up a very small proportion of total extended net worth. This is because when you are young, you are likely to earn a significant amount of income over your career. In this framework, if your remaining equity (again, top right corner) goes negative, you will be relying on debt to provide for yourself. This is how banks think about lending money to people. Credit cards, for example, are “secured” by the future earnings of the person with the credit card.

So why does this all matter? Well, it puts our daily financial decisions into perspective and helps us plan more deliberately for the future. As life goes on, we slowly reduce Future Earnings as it becomes realized through paychecks and when we spend those paychecks that reduces Future Consumption. If you want to buy that BMW, that will come at the expense of something else across your life. This also demonstrates that your lifetime assets won’t change meaningfully unless your career prospects, investment returns, or some other asset on your extended balance sheet changes. Imagine what starting a business or what expectations of a massive inheritence would do to this balance sheet. It would, in some sense, give you permission to take on more liabilities today. However, imagine if the health of a loved one deterioriated significantly and you had to take care of them for the rest of their life, increasing your extended liabilities significantly.

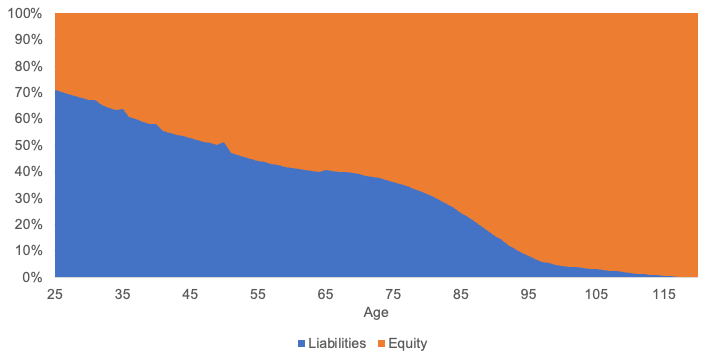

Above is the hypothetical balance sheet we have been discussing across age. You want to avoid a situation where you don’t have much equity left to handle emergencies like losing a job (reducing assets) or getting sick and having to pay high medical bills (increasing liabilities).

Support

If you’re interested in calculating these numbers for yourself, I’ve put together a spreadsheet letting you adjust goals, loans, and other personal financial characteristics so you can see your extended financial balance sheet across time. It’s a template, so you can copy it down and change the assumptions privately. I’ll also reach out with any updates to this template as I make them. Below is an example of what it looks like.

Thank you for your time!